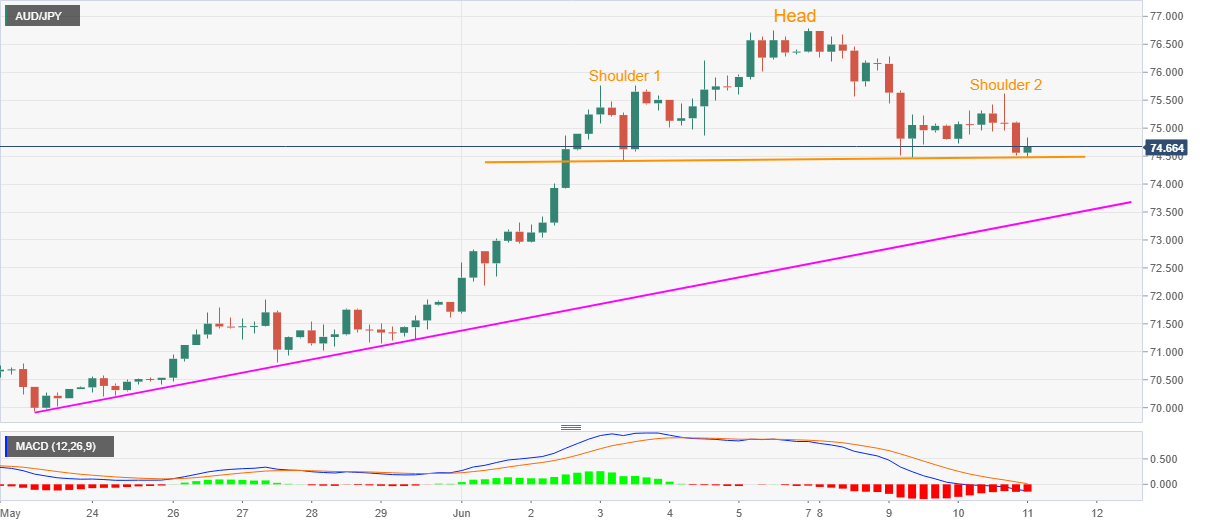

- AUD/JPY extends declines from 75.62 while portraying a bearish chart pattern.

- A three-week-old rising support line adds to the downside barriers.

- Multiple high above 76.50, bearish MACD keep the sellers hopeful.

AUD/JPY drops to 74.60, down 0.47% on a day, during the early Thursday. In doing so, the pair rests near the neckline of a short-term Head-and-Shoulders bearish formation on the 4-hour chart.

Other than the chart pattern, bearish MACD also favors the sellers. However, the bears need a clear break below 74.50 to justify the ability to target theoretically expected fall towards 72.20.

During the pair’s declines between 74.50 and 72.20, an ascending trend line from May 22, at 73.30 now, might offer an intermediate halt. Though, any more downside past-72.20 might not hesitate to visit May 27 top near 71.90.

On the upside, 75.60 and 76.00 might offer nearby resistance to the pair, a break of which could question the bearish chart pattern while aiming a break of 76.80.

It should, however, be noted that multiple highs marked during late-2019 and the early-2020 around 76.50 might question the bulls.

AUD/JPY four-hour chart

Trend: Further downside expected