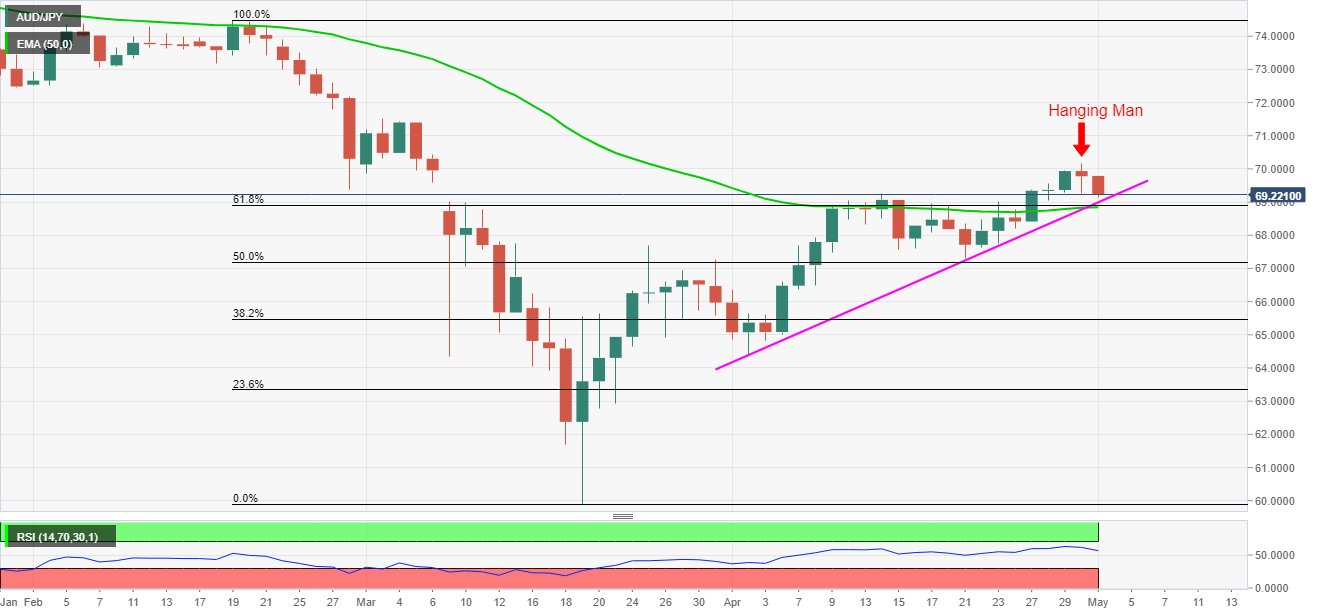

- AUD/JPY registers losses after flashing the bearish candlestick formation the previous day.

- A confluence of the monthly support trend line, 61.8% Fibonacci retracement and 50-day EMA question further downside.

AUD/JPY justifies Thursday’s bearish candlestick formation while declining to 69.25, down 0.80% on a day, during the pre-European session on Friday. Even so, a confluence of key technical indicators seems to check the sellers.

Not only the monthly support line, near 69.00, 61.8% Fibonacci retracement of February-March fall and 50-day EMA, around 68.90/85, also offers a strong challenge to the pair bears.

In a case where the quote registers a daily closing below 68.85, March 25 high near 67.70 and April 21 low close to 67.30 could return to the charts.

Alternatively, an upside break beyond the previous day’s top of 70.20 will defy the bearish candlestick formation and trigger fresh run-up towards March month high near 71.50.

AUD/JPY daily chart

Trend: Pullback expected