- AUD/JPY remains on the back foot near the lowest since early-2009.

- Bearish MACD, failure to cross near-term resistance favor sellers.

- Early-February 2009 high on the Bears’ radar.

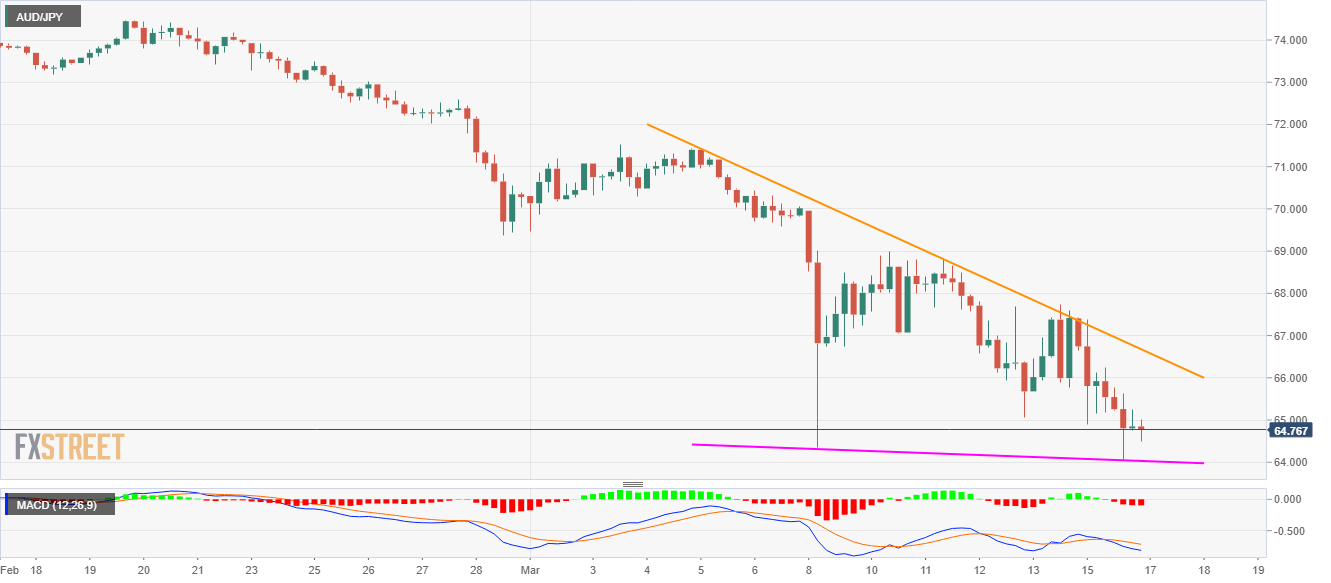

AUD/JPY extends the losses to 64.68 amid the early Tuesday morning in Asia. In doing so, the pair remains below an eight-day-old falling trend line amid bearish MACD.

As a result, the quote is likely to extend the south-run towards the immediate falling trend line, around 64.00 now.

However, the pair’s further declines below 64.00 might not refrain to target early-February 2009 highs near 62.60/65.

Meanwhile, an upside clearance of the multi-day-old resistance line, currently at 66.68, is less likely to renew buying interest unless clearing the previous month’s low near 69.40.

Following that, the buyers may aim to challenge the current monthly high near 71.40.

AUD/JPY four-hour chart

Trend: Bearish