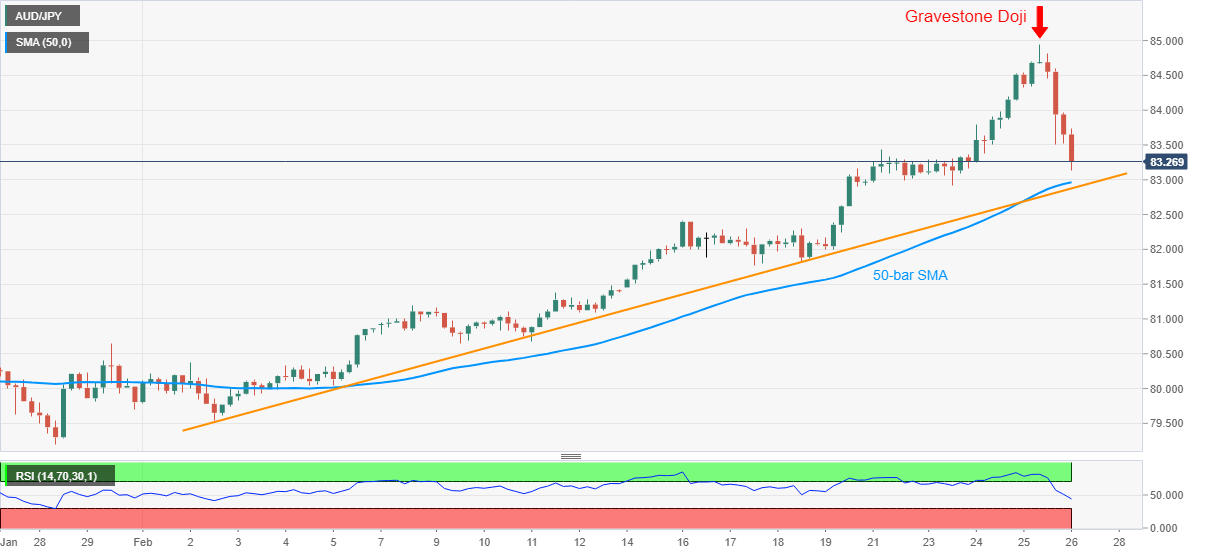

- AUD/JPY stays depressed while extending the previous day’s pullback moves.

- 50-bar SMA, 18-day-old support line probe immediate downside.

- Bulls need to defy Gravestone Doji at multi-month top to retake controls.

AUD/JPY holds lower ground near 83.25, down 0.40% intraday, during early Friday. The pair took a U-turn from a three-year high the previous day while flashing a bearish ‘gravestone Doji’ candlestick on the four-hour chart (4H). Also favoring the sellers could be the RSI drop from the overbought area.

However, a confluence of 50-bar SMA and an ascending trend line from February 02 currently tests the AUD/JPY bears around 82.90-85.

Should the quote drops below 83.85, the mid-month top near 82.40 and December 17 low near 81.75 will lure the sellers ahead of highlighting the 81.00 threshold.

Meanwhile, the corrective pullback may eye the 84.00 round-figure whereas 84.30 and 84.55 can test the AUD/JPY buyers afterward.

Though, bulls are less likely to be convinced unless crossing the latest top near 85.00, which in turn will reject the bearish candlestick formation.

AUD/JPY four-hour chart

Trend: Further weakness expected