- AUD/JPY recovers from multi-week low, confronts short-term key resistance.

- Bearish MACD, RBA’s expected dovish halt might drag the pair downwards.

- November 2019 low can please buyers during the upside break.

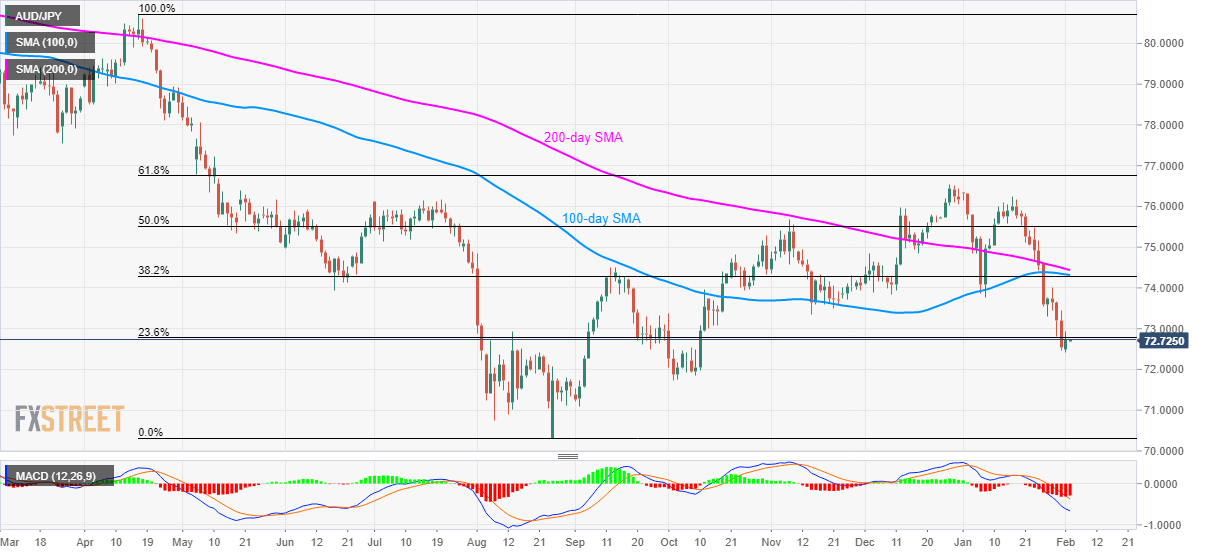

AUD/JPY holds onto recovery gains while trading around 72.70 amid the initial Asian trading hours on Tuesday. The pair’s bounce from 16-week low confronts 23.6% Fibonacci retracement of its April-August 2019 fall ahead of the key RBA interest rate decision

While comparing bearish MACD and the pair’s trading below the key supports to the likelihood of the RBA’s dovish halt, the quote is expected to remain weak.

With this, sellers will look for entry below Monday’s low of 72.40 to take aim at 71.85/75 support zone comprising October 2019 lows.

Alternatively, November 2019 monthly bottom near 73.35 and the previous month’s trough close to 73.75/80 can offer immediate resistance to the pair during its further recovery.

However, a confluence of 100-day SMA and 38.2% Fibonacci retracement, around 74.30, could keep the bulls challenged then after.

AUD/JPY daily chart

Trend: Bearish