- AUD/JPY fails to extend the bounce off 71.17 much beyond 71.43.

- Japan’s Retail Sales, Tokyo CPI and Unemployment Rate flashed better than forecast results.

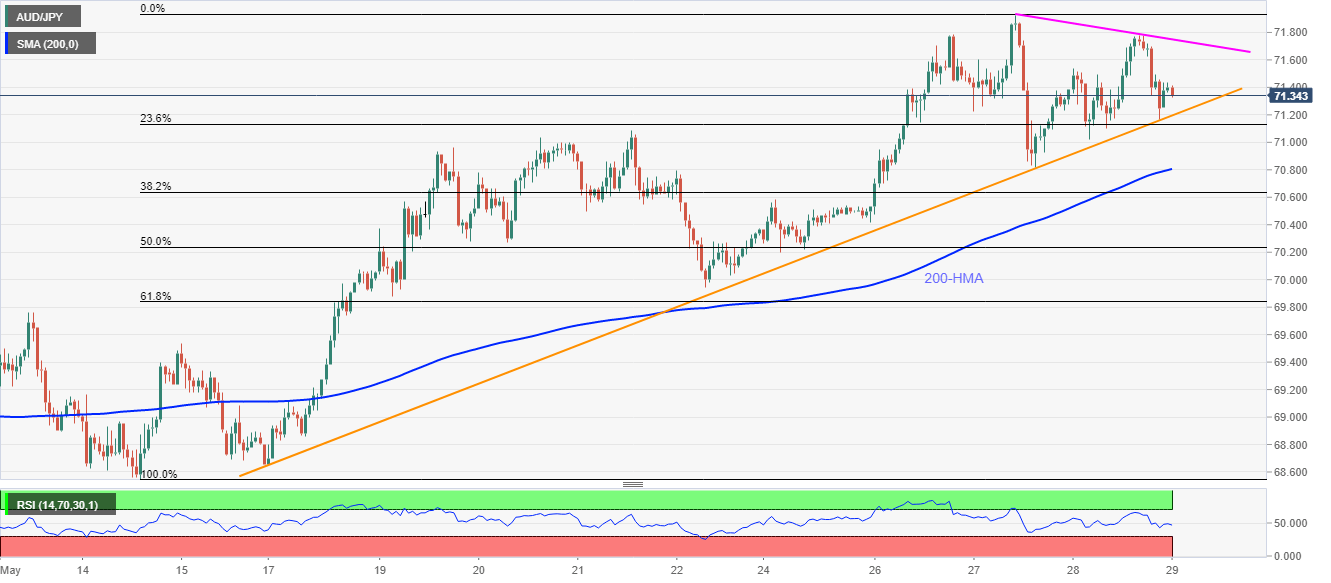

- 200-HMA adds to the downside support below a two-week-old rising trend line.

- Buyers will wait for a sustained break above the weekly resistance line.

AUD/JPY drops to 71.33 after the key economics from Japan recently weighed on the pair amid the initial Asian session on Friday.

Read: Tokyo area May Core CPI +0.2% YoY smashes estimates of ‐0.2%

Even so, the quote stays above an upward sloping trend line stretched from May 15, at 71.20 now, a break of which could drag the AUD/JPY prices towards a 200-HMA level of 70.80.

In a case where the bears dominate past-70.80, 70.00 and May 13 top near 69.75 could become their favorites.

Meanwhile, 71.55 my offer immediate resistance ahead of the weekly falling trend line, currently around 71.75.

Should there be a clear run-up beyond 71.75, 72.00 and January month low near 72.45 may return to the charts.

AUD/JPY hourly chart

Trend: Bullish