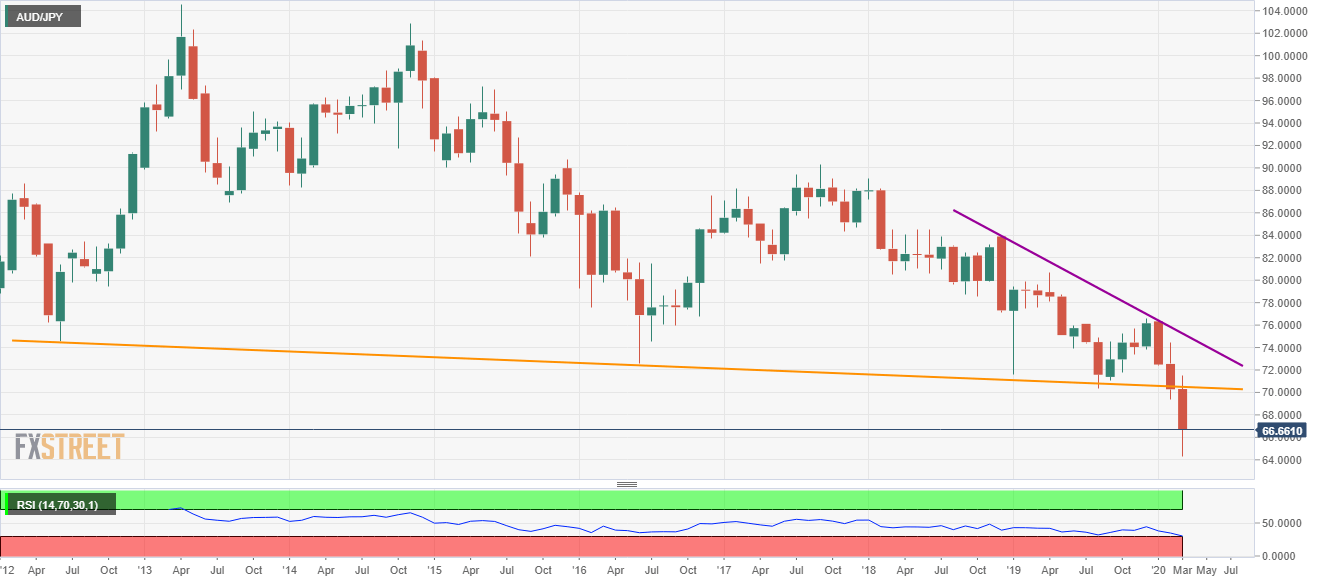

- AUD/JPY plummets to the multi-year bottom following a sustained break of the long-term support trend line.

- Oversold RSI signals pullback but buyers may refrain entry unless the quote bounces back beyond the support-turned-resistance.

AUD/JPY tanked to 64.34, currently around 66.70 with 4.7% loss, amid the Asian session on Monday. In doing so, the pair refreshed the lowest levels since March 2009.

The pair recently extended its downpour past multi-month descending trend line stretched from June 2012.

As a result, the bears can tighten their grip over early-2009 levels near 62.00 while targeting 60.00 round-figure during further weakness.

Alternatively, oversold RSI conditions favor a pullback towards the support-turned-resistance, at 70.55.

However, the pair’s upside past-70.55 can be challenged by the downward sloping trend line from December 2018, near 75.50 now.

AUD/JPY monthly chart

Trend: Pullback expected