- AUD/JPY catches a breather during the week’s recovery moves.

- MACD teases bears but needs validation from the stated channel.

- Key Fibonacci retracement levels will probe buyers outside the bullish pattern.

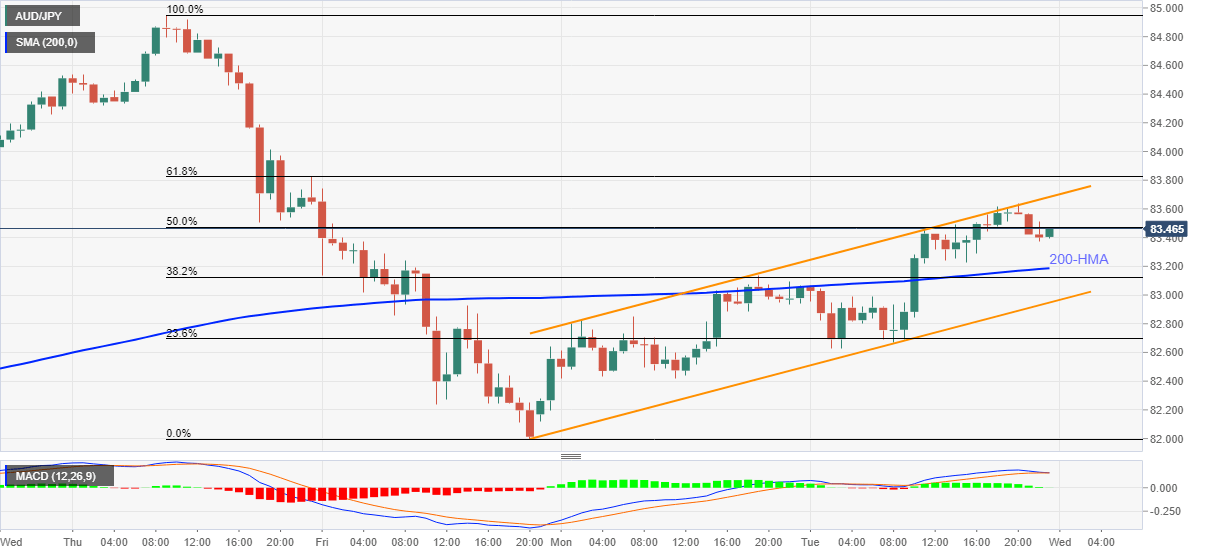

AUD/JPY fades the early week’s corrective pullback while stepping back to 83.43, despite keeping the bullish chart formation, during the initial Asian session on Wednesday. In doing so, the quote eases from the upper line of the weekly ascending trend channel ahead of the fourth-quarter (Q4) Australia GDP data.

Read: Australian GDP Preview: Prospects for a sustained economic recovery

Given the cautious sentiment ahead of the key data, coupled with not upbeat expectations from GDP, AUD/JPY may extend the pullback moves towards the 200-HMA level of 83.18.

Also supporting the hopes of further weakness could be the MACD conditions that seem to tease bears.

However, AUD/JPY sellers are less likely to turn serious until witnessing an hourly close below the support line of the stated channel, at 82.95 now, which in turn should challenge the weekly bottom surrounding 82.00.

Meanwhile, an upside break of the channel’s resistance line, currently around 83.70, will have to cross the 61.8% Fibonacci retracement of February 25-26 downside, around 83.85, before recalling the AUD/JPY buyers.

Following that, the multi-month top posted in February around the 85.00 threshold will be the key to watch.

AUD/JPY hourly chart

Trend: Pullback expected