- AUD/JPY prints three-day winning streak to refresh the highest levels since June 10.

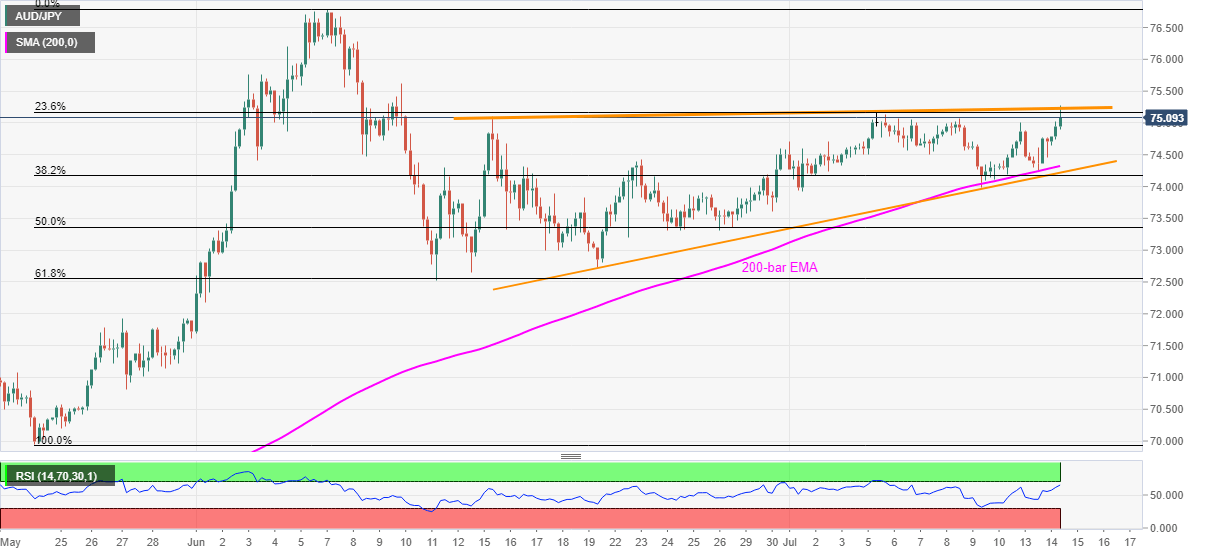

- An upward sloping trend line from June 16 guards immediate advances.

- 200-bar EMA, short-term ascending support line gains more attention amid nearly overbought RSI conditions.

AUD/JPY takes the bids near 75.13, up 0.44% on a day, during the early Wednesday. The pair recently surged to the highest in over a monthly amid a broad rise in the Australian dollar. However, RSI conditions and an immediate resistance line question the bulls off-late.

Hence, sellers will look for entry if the pair slips below Monday’s high of 75.00. Though, 200-bar EMA and a rising trend line from June 21, respectively, around 74.30 and 74.20, will restrict the quote’s further weakness.

In a case where the AUD/JPY sellers dominate past-74.20, the bearish formation named rising wedge will be confirmed, which in turn could drag the quote towards 72.00.

On the flip side, a sustained run-up past-75.00 enables the bulls to aim for June 10 high near 75.60.

Further, the pair’s ability to stay strong above 75.60 will easily cross the 76.00 threshold to challenge the previous month’s peak surrounding 76.80.

AUD/JPY four-hour chart

Trend: Pullback expected