- AUD/JPY remains on the back foot for the third consecutive day.

- Japan’s Merchandise Trade Balance beat ¥-37.5 B forecast in August.

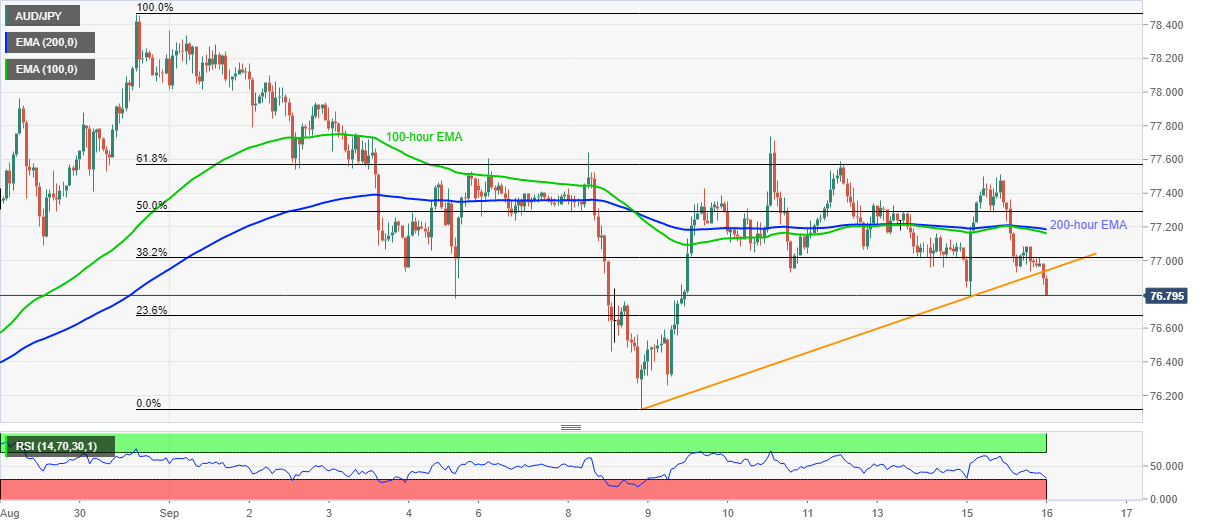

- Sustained trading below 100-hour and 200-hour EMA also favors the sellers.

- Bulls need a sustained break of September 10 high to regain controls.

AUD/JPY drops to 76.87, down 0.15% on a day, as Wednesday’s trading in Tokyo begins. The pair recently reacted to the upbeat trade numbers from Japan. In doing so, the quote slips below an ascending trend line from September 08.

As a result, sellers are targeting 76.70 and 76.50 as immediate supports ahead of the monthly low of 76.12.

It should additionally be noted that the 76.00 threshold and August 21 low near 75.65 can lure the sellers during the AUD/JPY price weakness below 76.12.

On the contrary, a confluence of the key EMAs around 77.20 guards the pair’s immediate upside moves ahead of the 61.8% Fibonacci retracement of August 31 to September 08 fall, close to 77.60.

In a case where the bulls manage to dominate past-77.60, the September 10 high of 77.73 will challenge the further upside ahead of highlighting the monthly peak of 78.36.

Talking about the data, Japan’s Merchandise Trade Balance Total grew ¥248.3 B versus ¥10.9 B (revised) prior and ¥-37.5 B market consensus in August. Additional details suggest that the Imports dropped below -18% YoY forecast to -20.8 whereas Exports recovered from -16.1% to -14.8% in the reported month.

AUD/JPY hourly chart

Trend: Further weakness expected