- AUD/JPY sold-off into risk-aversion, as Sino-US tensions intensify.

- Technical set up appears bearish but oversold RSI suggests a bounce.

- Downbeat US PMIs could revive the downside momentum.

AUD/JPY, the fear gauge, remains heavy in the European session, although recovers from four-day lows of 75.14 reached in the last hours.

The cross tumbled in tandem with the risk sentiment after China announced its retaliation against the US’ order to close the former’s consulate in Houston on Tuesday. At the press time, the spot trades at 75.34, still down 0.66%.

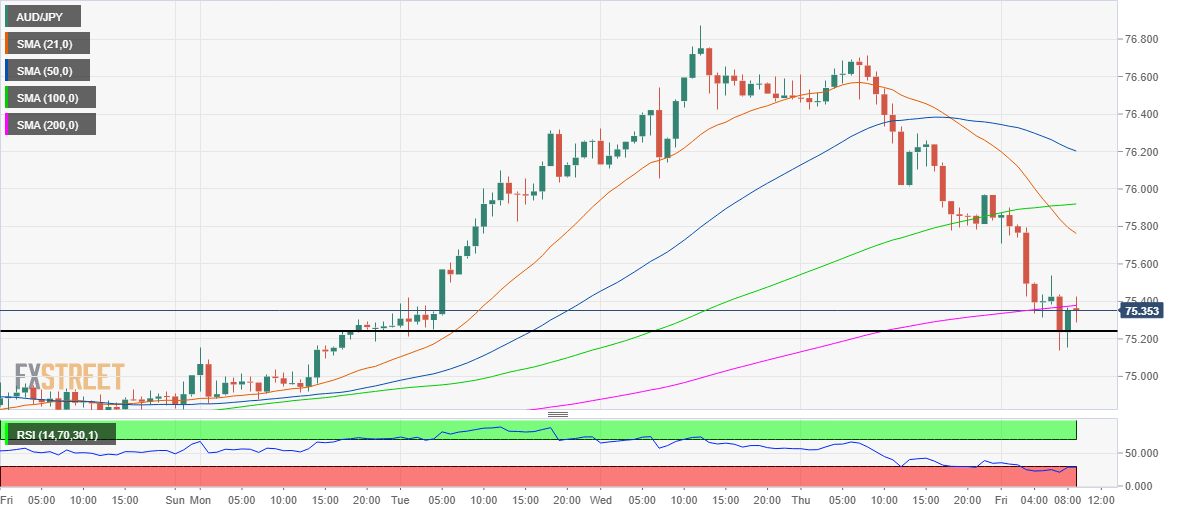

The bears take a breather, as the hourly Relative Strength Index (RSI) has bounced-off the oversold region, suggesting a minor pullback on the cards.

Therefore, the price could recover towards the bearish 21-hourly Relative Strength Index (RSI) at 75.75, above which the horizontal 100-HMA resistance at 75.92 will be tested.

Alternatively, sellers would return on a break below the critical horizontal support at 75.23, which will validate the rounding top formation on the hourly sticks.

The pattern breakdown will call for an extensive sell-off, opening floors for a test of the 74 level.

To conclude, any pullbacks could likely remain short-lived, as 21-HMA and 100-HMA bearish crossover, suggests that the bears are here to stay.

AUD/JPY Hourly Chart

AUD/JPY Additional levels