- AUD/JPY remains positive with bullish MACD.

- Further upside challenged by near-term trend-line resistance and a confluence of 50% Fibonacci retracement, 4H 100MA.

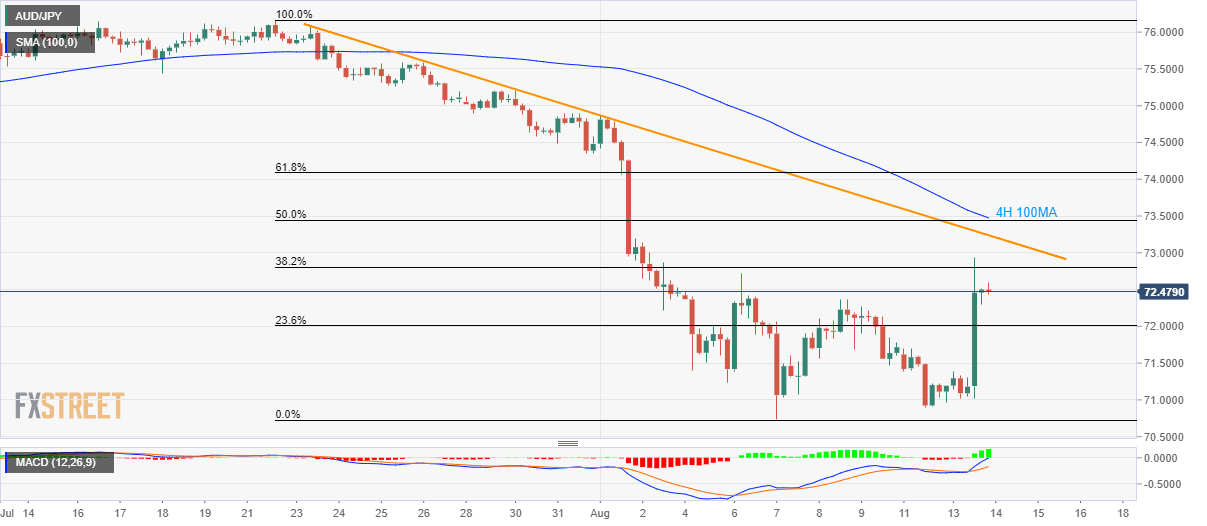

Following its run-up to the eight-day high, AUD/JPY seesaws near 72.48 during the early Asian session on Wednesday.

While the bullish signal from moving average convergence and divergence (MACD) favor the pair’s further upside, 38.2% Fibonacci retracement of late-July to early August decline, at 72.80, becomes immediate resistance to watch.

Should prices manage to rise past-72.80, a downward sloping trend-line since July 23 can question further upside at 73.24, a break of which can escalate the advances to 73.44/48 confluence including 50% Fibonacci retracement and 100-bar moving average on the 4-hour chart (4H 100MA).

If the quote surges above 73.48, 61.8% Fibonacci retracement near 74.10 and July 31 low near 74.35 could lure buyers.

On the downside, 71.40 and recent low surrounding 70.75 can keep sellers away from 70.00 round-figure.

AUD/JPY 4-hour chart

Trend: Pullback expected