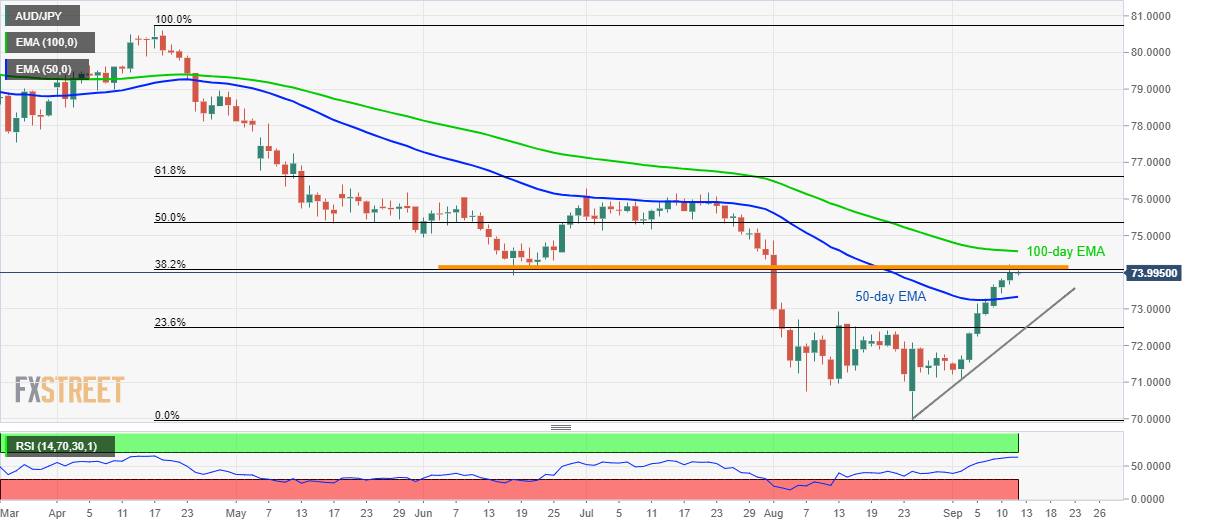

- AUD/JPY stays above 50-day EMA, aims to cross key resistance including 38.2% Fibonacci retracement level amid overbought RSI.

- 100-day EMA and 50% Fibonacci retracement follow the breakout.

AUD/JPY seesaws near the six week high, while confronting the crucial upside barrier, as it takes the rounds to 74.00 during early Thursday morning in Asia.

While sustained trading beyond 50-day exponential moving average (EMA) and a seven-day-old winning streak portray the pair’s strength, further advances seems to be challenged by 74.05/15 region comprising 38.2% Fibonacci retracement of April-August declines and June 20/21 low.

Also adding the question-mark to the extended rise is overbought conditions of 14-day relative strength index (RSI).

Should prices rally beyond 74.15 on a daily closing basis, 100-day EMA around 74.60 and 50% Fibonacci retracement close to 75.35 will be on the bulls’ list.

On the downside, pair’s closing below 50-day EMA level of 73.30 will be considered a trigger to drag the quote to 23.6% Fibonacci retracement level of 72.50 while a fortnight old rising trend-line, at 72.32 now, could restrict additional declines.

AUD/JPY daily chart

Trend: pullback expected