- AUD/JPY trades near 78.20 ahead of the Bank of Japan’s (BoJ) monetary policy meeting on early Friday.

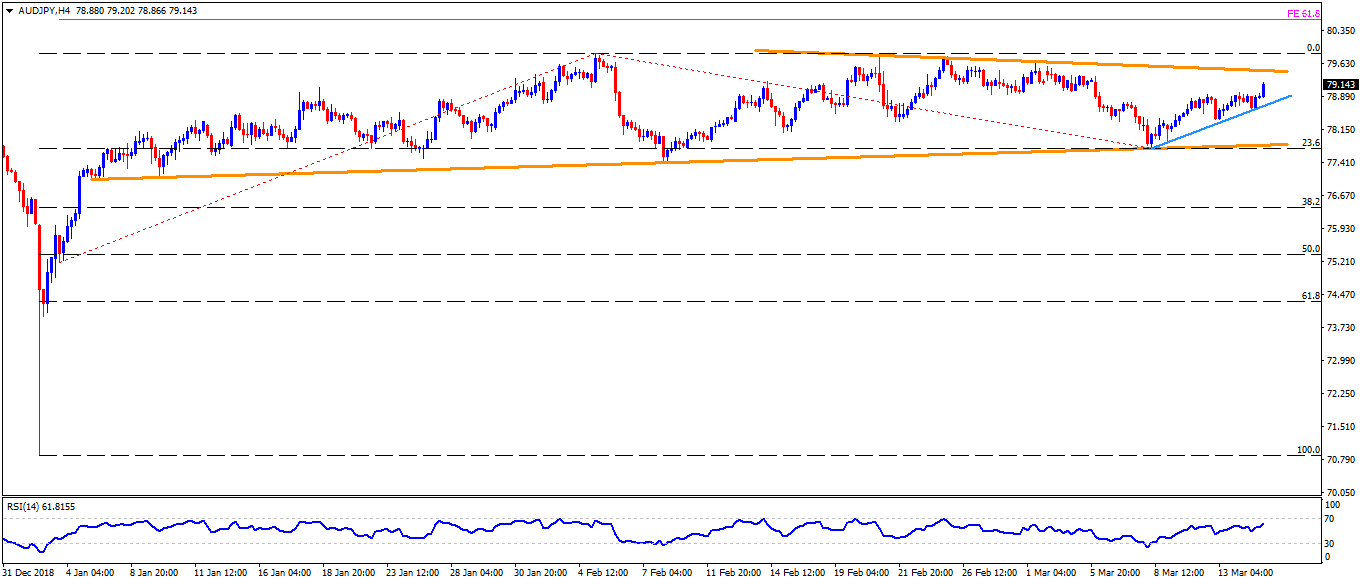

- The quote recently confirmed inverse head and shoulders bullish formation by clearing 79.00 on hourly chart and is presently rising toward three-week-old descending trend-line, at 79.50.

- Should prices manage to cross 79.50 immediate upside barrier, February month highs near 79.80/85 could act as buffers prior to highlighting 80.00 round-figure.

- Also, 61.8% Fibonacci expansion (FE) of its early January – March moves, around 80.60, may gain buyers’ attention post-80.00.

- Alternatively, pair’s dip beneath 79.00 can take rest on a weeklong upward sloping support-line at 78.60, a break of which may extend the pullback to 78.30 and 78.00.

- However, an ascending trend-line stretched since January 07 can challenge sellers around 77.70, if not then 77.00 can come back on the chart.

AUD/JPY 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 79.16

Today Daily change: 25 pips

Today Daily change %: 0.32%

Today Daily Open: 78.91

Trends:

Daily SMA20: 78.97

Daily SMA50: 78.58

Daily SMA100: 79.71

Daily SMA200: 80.55

Levels:

Previous Daily High: 78.98

Previous Daily Low: 78.57

Previous Weekly High: 79.65

Previous Weekly Low: 77.72

Previous Monthly High: 79.85

Previous Monthly Low: 77.44

Daily Fibonacci 38.2%: 78.82

Daily Fibonacci 61.8%: 78.73

Daily Pivot Point S1: 78.66

Daily Pivot Point S2: 78.41

Daily Pivot Point S3: 78.25

Daily Pivot Point R1: 79.07

Daily Pivot Point R2: 79.23

Daily Pivot Point R3: 79.48