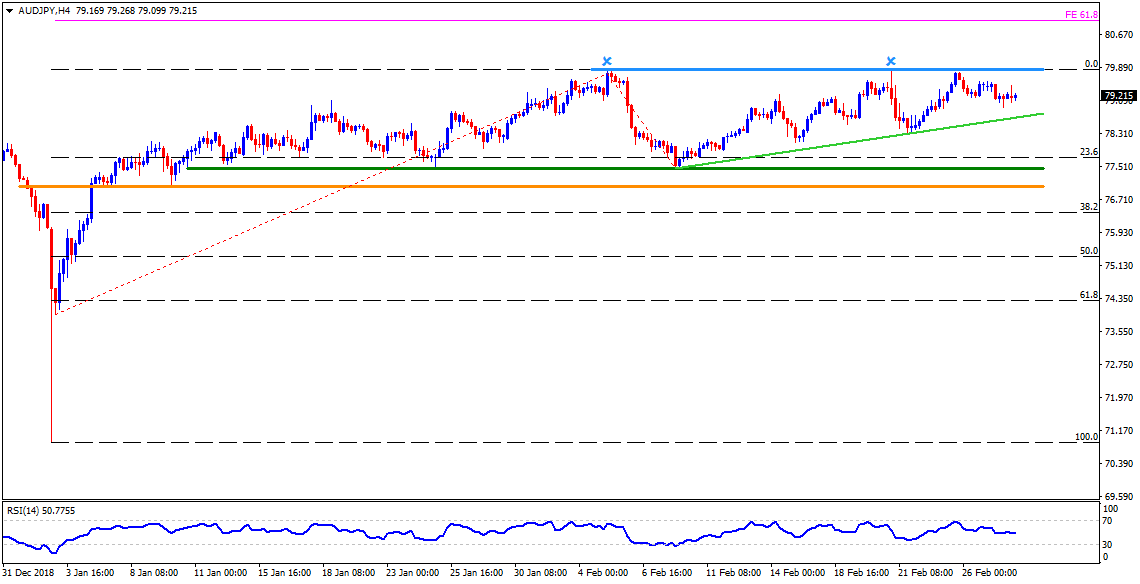

- AUD/JPY is on rounds near 79.20 close to European open on Thursday.

- The pair is gradually recovering since February 08 but is still trading beneath the 79.80-85 horizontal-resistance that confined its upside during Feb 05 and 21.

- As a result, the pair needs to surpass 79.85 barrier in order to justify its strength toward targeting 61.8% Fibonacci expansion (FE) of its early January to February moves, near 81.00.

- Though, 79.55 may offer immediate stop during the pair’s upside.

- On the downside, an upward sloping trend-line portraying the pair’s recent recovery, at 78.65, can limit the pair’s near-term declines, a break of which can drag it to 78.30 and 78.00 rest-points.

- It should also be noted that the pair’s downturn past-78.00 may avail 77.40 and 77.00 as follow-on supports.

AUD/JPY 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 79.24

Today Daily change: 1 pips

Today Daily change %: 0.01%

Today Daily Open: 79.23

Trends:

Daily SMA20: 78.87

Daily SMA50: 78.31

Daily SMA100: 79.82

Daily SMA200: 80.78

Levels:

Previous Daily High: 79.57

Previous Daily Low: 78.94

Previous Weekly High: 79.82

Previous Weekly Low: 78.33

Previous Monthly High: 79.4

Previous Monthly Low: 70.71

Daily Fibonacci 38.2%: 79.18

Daily Fibonacci 61.8%: 79.33

Daily Pivot Point S1: 78.92

Daily Pivot Point S2: 78.61

Daily Pivot Point S3: 78.29

Daily Pivot Point R1: 79.55

Daily Pivot Point R2: 79.88

Daily Pivot Point R3: 80.19