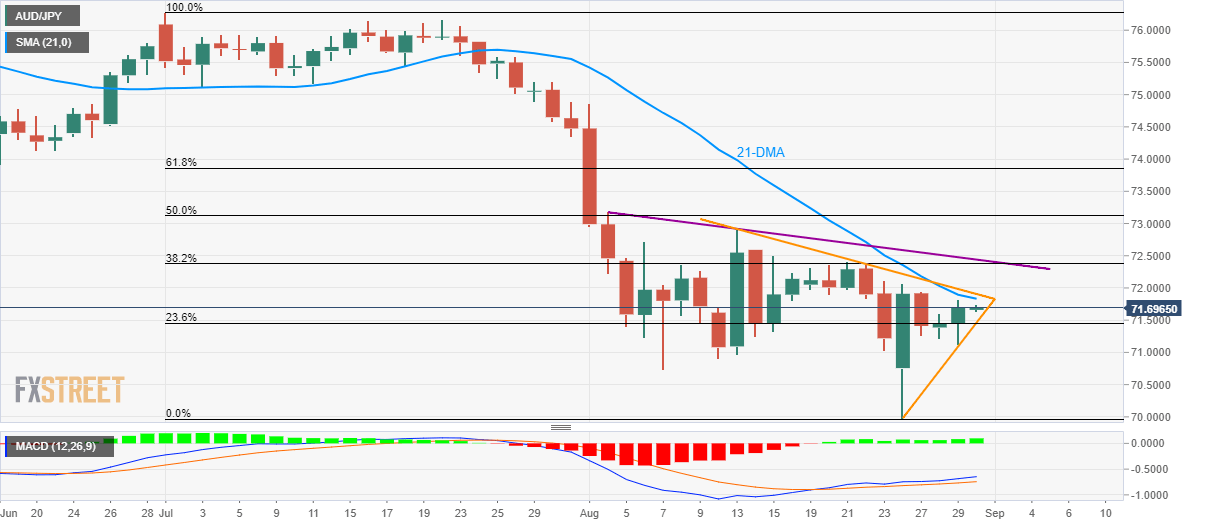

- The four-day-old support-line favor AUD/JPY to again confront 21-DMA.

- Downward sloping trend-lines from August 02 and 13 become additional upside barriers.

Sustained trading beyond four-day-old rising trend-line favors AUD/JPY to aim for 21-day simple moving average (DMA) as it makes the rounds to 71.70 during early Asian session on Friday.

Other than 21-DMA level of 71.83, a falling trend-line since August 13 at 71.91 and another one ranging from August 02 around 72.44 are extra upside barriers that the quote needs to conquer in order to justify its strength.

In a case where prices rally beyond 72.44, 50% Fibonacci retracement of July-August downpour, also including August 02 top, can question AUD/JPY buyers around 73.15/20.

Meanwhile, pair’s break of 71.46/45 support-zone comprising immediate rising trend-line and 23.6% Fibonacci retracement can please sellers with August 07 low surrounding 70.70 ahead of pushing them to 70.00/69.95 area including the monthly bottom.

AUD/JPY daily chart

Trend: pullback expected