- The Australian Dollar (AUD) is taking the bids near 78.95 against the Japanese Yen (JPY) on early Thursday.

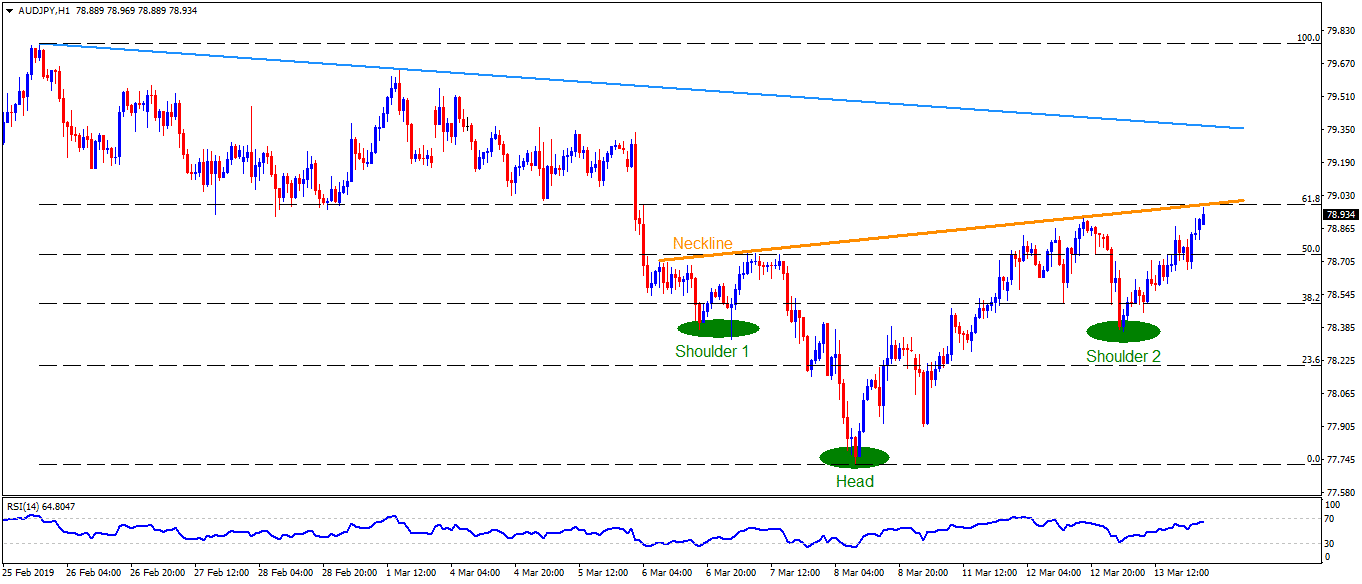

- AUD/JPY is forming an inverse head and shoulders pattern on the hourly chart that needs to be validated by a sustained break of 79.00 neckline figure.

- Should this happen, prices can rally theoretically towards $80.00 but a descending trend-line stretched since February 25, followed by the late last-month high, may challenge buyers around 79.40 and 79.80.

- In a case prices witness pullback, 50% Fibonacci retracement level near 78.70 and 78.30 are likely immediate supports to watch.

- During the pair’s additional weakness post-78.30, 78.00 and 77.70 may flash on bears’ radar.

AUD/JPY hourly chart

Additional important levels:

Overview:

Today Last Price: 78.94

Today Daily change: 8 pips

Today Daily change %: 0.10%

Today Daily Open: 78.86

Trends:

Daily SMA20: 78.94

Daily SMA50: 78.46

Daily SMA100: 79.72

Daily SMA200: 80.6

Levels:

Previous Daily High: 78.93

Previous Daily Low: 78.51

Previous Weekly High: 79.65

Previous Weekly Low: 77.72

Previous Monthly High: 79.85

Previous Monthly Low: 77.44

Daily Fibonacci 38.2%: 78.77

Daily Fibonacci 61.8%: 78.67

Daily Pivot Point S1: 78.6

Daily Pivot Point S2: 78.35

Daily Pivot Point S3: 78.18

Daily Pivot Point R1: 79.02

Daily Pivot Point R2: 79.19

Daily Pivot Point R3: 79.44