- AUD/JPY remains strong above seven-day-old support-line, 10-DMA.

- August 06 high, 21-DMA gain buyers’ attention amid bullish MACD.

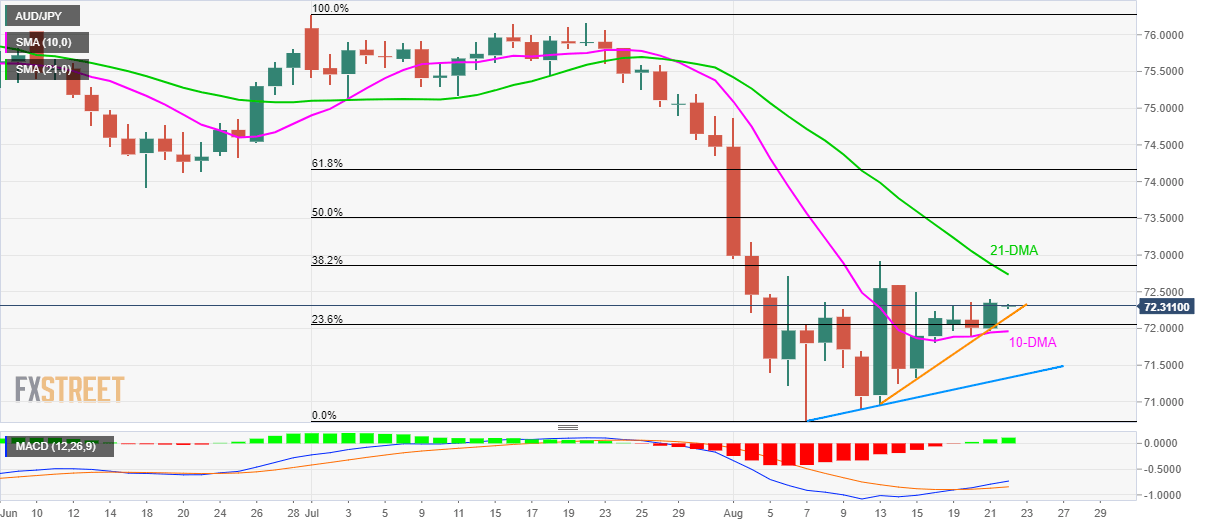

With the near-term rising trend-line and 10-DMA firmly supporting the AUD/JPY pair’s upside to 21-DMA, the pair currently takes the rounds to 72.30 during the Asian session on Thursday.

Not only 21-day simple moving average (DMA) but August 06 high also emphasize 72.72/73 as near-term key resistance, a break of which can propel prices to 38.2% Fibonacci retracement of July-August declines, at 72.86.

It should, however, be noted that pair’s successful rise above 72.86 needs to clear 73.20, comprising August 03 high, in order to recall bulls targeting July 31 low near 74.90.

Also supporting the upside is bullish signal by the 12-bar moving average convergence and divergence (MACD).

On the downside, seven-day-old rising trend-line, at 72.16, and 10-DMA level of 71.96 can keep the pair’s declines limited, if not then a two-week-old support-line of 71.33 will gain sellers’ attention.

If at all bears dominate past-71.33, latest lows near 70.74 and 70.00 round-figure will become their favorites.

AUD/JPY daily chart

Trend: Recovery expected