- AUD/JPY retraces after a strong performance during the previous day.

- Sustained run-up beyond 200-DMA, 50% Fibonacci retracement favor the Bulls.

- A daily closing beyond 61.8% Fibonacci retracement becomes necessary for fresh buying, overbought RSI challenges the sentiment.

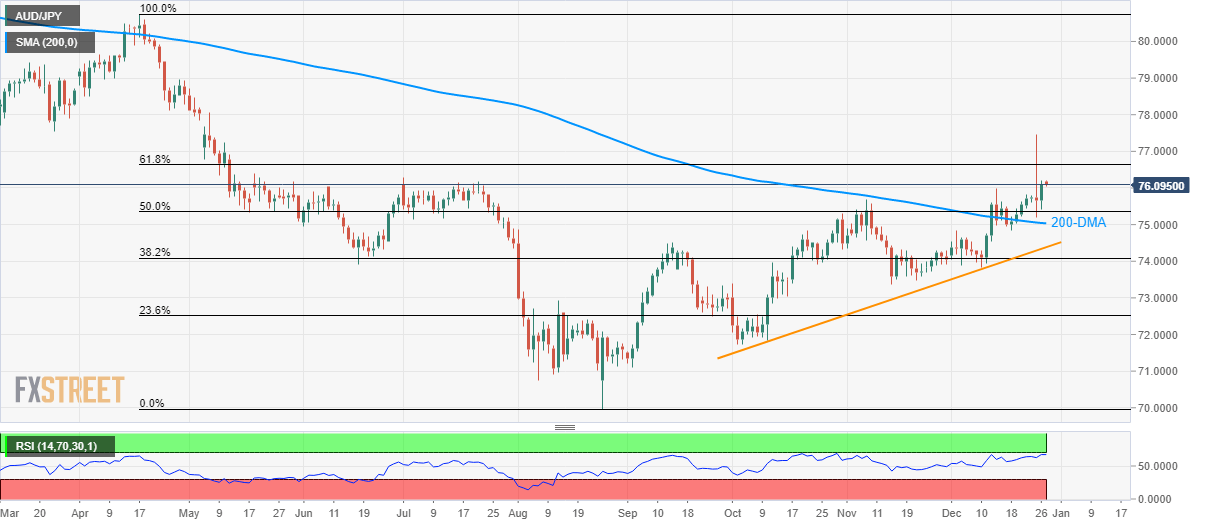

AUD/JPY pulls back from multi-month high to 76.10 during Friday’s Asian session. Overbought conditions of 14-day Relative Strength Index (RSI) and trading below 61.58% Fibonacci retracement of April-August 2019 fall might have triggered the recent declines.

Even so, the pair stays above 50% Fibonacci retracement level of 75.36 and 200-Day Simple Moving Average (DMA) level of 75.03, which in turn speaks louder of its strength.

Should prices drop below 75.00 round-figure on a daily closing basis, an upward sloping trend line since early-October, near 74.40/38 could return to the charts.

Meanwhile, an upside break of the 61.8% Fibonacci retracement level of 76.63 will enable the Bulls to aim for March 25 low close to 77.55.

During the pair’s extended rise beyond 77.55, April 29 top of 78.97 and 80.00 round-figure will be in the spotlight.

AUD/JPY daily chart

Trend: Pullback expected