- AUD/JPY fails to break 50-day EMA, four-week-old support-line in the spotlight for now.

- RBA matched market expectations of a 0.25% rate cut.

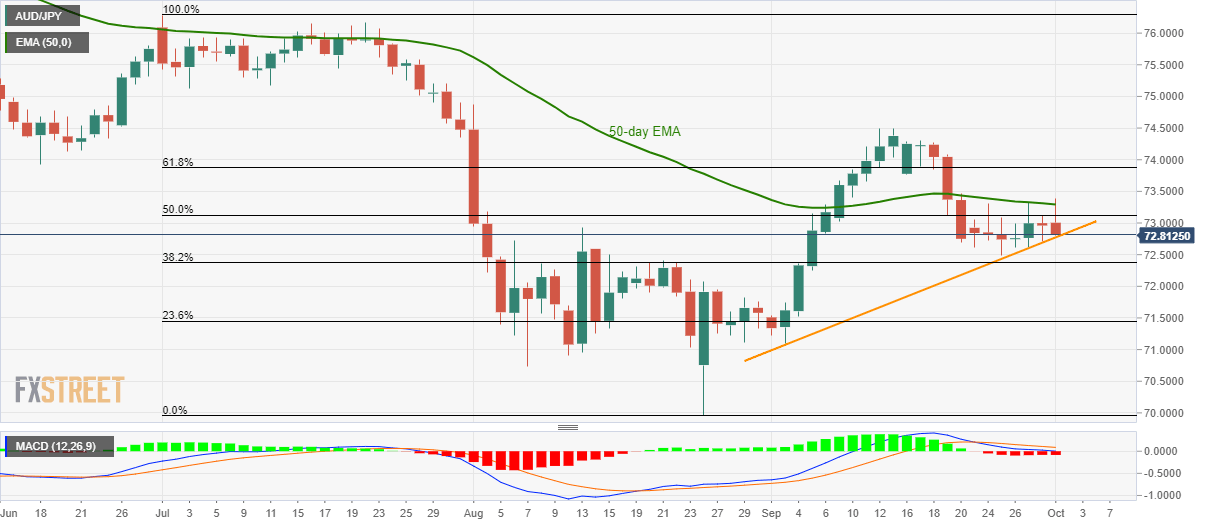

Following initial spikes to 50-day exponential moving average (EMA), AUD/JPY aims to revisit short-term support-line while taking rounds to 72.85 during early-Tuesday.

The Reserve Bank of Australia (RBA) matched market-wide expectations while announcing a 0.25% Cash Rate cut. However, RBA statement offered details of decision and conveys a dovish bias.

Read: RBA: Reasonable to expect extended period of low rates

With the bearish signal from 12-day moving average convergence and divergence (MACD) grabbing sellers’ attention, a downside break of near-term rising trendline support, at 72.75, can extend declines to 38.2% Fibonacci retracement of July-August downpour, at 72.37.

On the upside, pair’s successful break of 50-day EMA level, at 73.30 now, could push buyers to confront 61.8% Fibonacci retracement level surrounding 73.90. However, September month high near to 74.50 could restrict the pair’s further upside.

AUD/JPY daily chart

Trend: pullback expected