- AUD/NZD extends recovery moves from one week low of 1.0651.

- Monthly resistance line adds to the upside barriers.

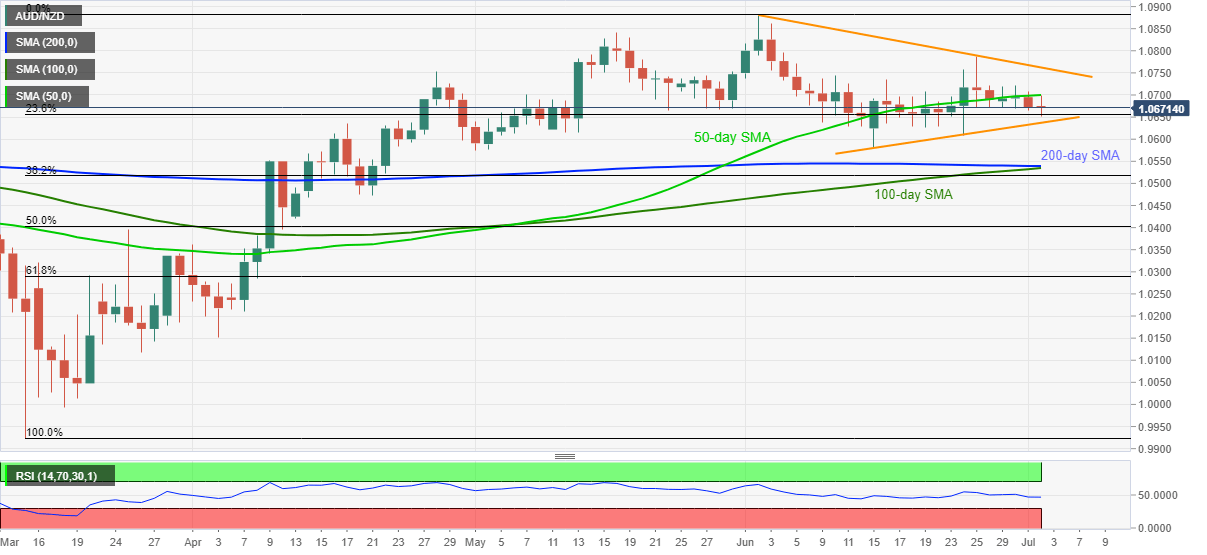

- A confluence of 100 and 200-day SMA becomes the key support.

AUD/NZD takes the bids near 1.0672 during the early Asian session on Thursday. The pair recently bounces off the weekly bottom surrounding 1.0650. However, 50-day SMA questions the pullback moves.

As a result, sellers remain hopeful to revisit a 13-day-old support line, at 1.0635 now, a break of which could drag the quote to June 15 low near 1.0580. However, 100 and 200-day SMAs will question the pair’s further downside around 1.0540/35.

Should there be a daily closing below 1.0535, the bears may target 50% Fibonacci retracement of March-June upside, at 1.0400, during the additional weakness.

Meanwhile, a clear break of 50-day SMA, at 1.0700 now, can escalate the quote’s U-turn towards a descending trend line from June 02 near 1.0760 ahead of pushing the buyers to June 25 peak close to 1.0790.

AUD/NZD daily chart

Trend: Pullback expected