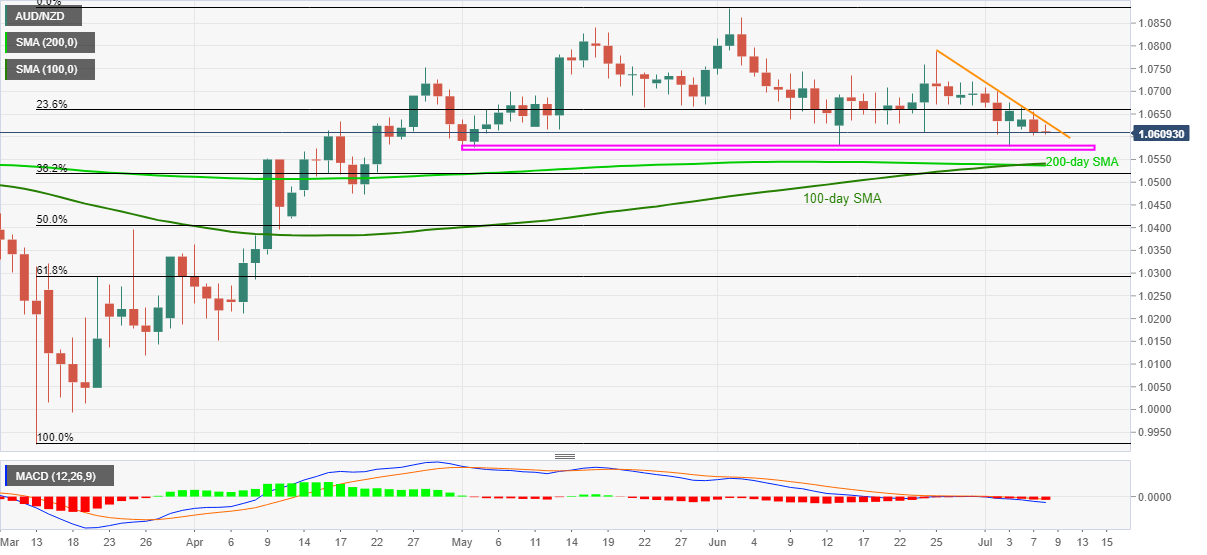

- AUD/NZD extends the previous day’s losses amid bearish MACD.

- A nine-day-old descending trend line guards immediate upside.

- A confluence of 100-day and 200-day SMAs offer strong support below the 1.0570/80 zone.

AUD/NZD remains on the back foot around 1.0610 amid the early Wednesday morning in Asia. The pair snapped a two-day winning streak the previous day while taking a U-turn from a short-term falling trend line resistance.

Considering the bearish MACD, as well as sustained trading below an immediate resistance line, the quote is likely to extend its weakness.

In doing so, a horizontal area comprising lows marked since the early May month, around 1.0570/80, appears on the bears’ minds. However, a joint of 100/200-day SMAs near 1.0535/40 will be a strong support to challenge the sellers afterward.

In a case the pessimism prevails past-1.0535, odds of the AUD/NZD price-drop to 1.0500 threshold, before visiting April 21 low around 1.0470, can’t be ruled out.

Meanwhile, buyers look for entry beyond the downward sloping trend line from June 25, at 1.0632 now. Should that happen, the monthly top near 1.0710 and late-June peak surrounding 1.0790 can offer bumps on the way to 1.0800 psychological magnet.

However, the pair’s ability to stay strong beyond 1.0800 could easily question the June month high of 1.0883.

AUD/NZD daily chart

Trend: Bearish