- AUD/NZD fails to respect Friday’s bounce off seven month low.

- New Zealand Retail Sales grew 28% in Q3 versus prior contraction of 14.6%.

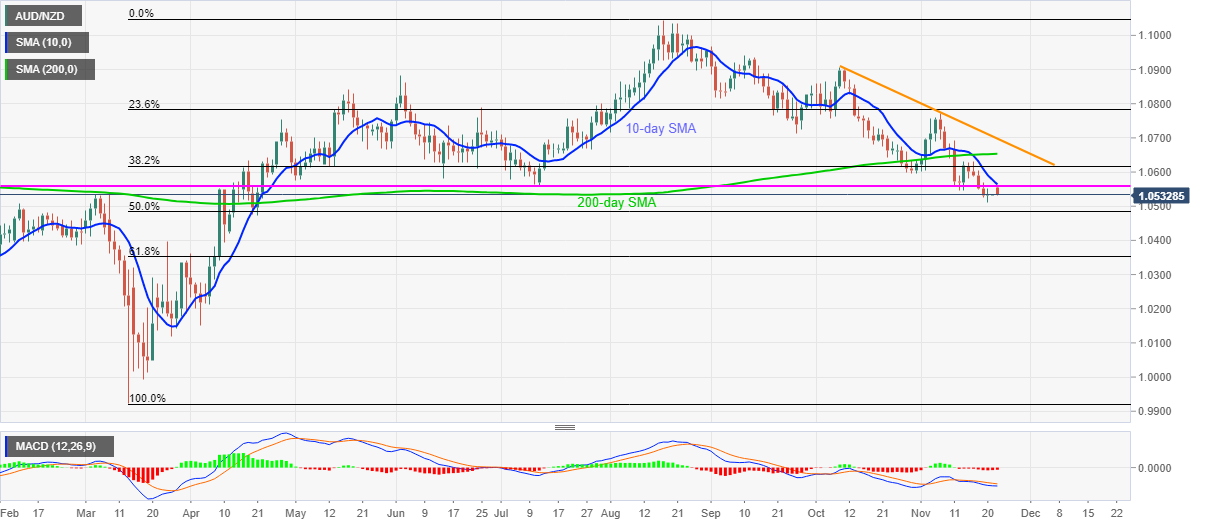

- 10-day SMA, July low restricts immediate upside, bears can eye 50% Fibonacci retracement level of March-August upside.

AUD/NZD stays heavy near the lowest since late-April while taking rounds to the intraday low around 1.0530 during the early Asian session on Monday. The pair recently slumped from 1.0555 to 1.0531 after New Zealand’s (NZ) third quarter (Q3) Retail Sales offered a big beat to the prior release.

Not only the NZ Retail Sales that rose beyond the previous -14.6% to 28% but the Retail Sales ex-Autos, mostly known as Core Retail Sales, also recovered from -13.7% prior to +24.1% QoQ in the Q3.

Read: New Zealand’s Retail Sales unexpectedly jumps 28% in Q3, NZD/USD bounces

Following the data, the pair extends its reversal from a confluence of 10-day SMA and July low, currently near 1.0563/58, which in turn drags the quote towards the recently flashed multi-day low of 1.0510.

During the pair’s additional weakness past-1.0510, the 50% of Fibonacci retracement level near 1.0480 and March 25 high around 1.0220 will lure the AUD/NZD bears.

On the contrary, an upside clearance of 1.0563 on a daily closing isn’t enough to recall the bulls as 200-day SMA and a falling trend line from October 08, respectively around 1.0655 and 1.0700, stand tall to challenge the recovery moves.

AUD/NZD daily chart

Trend: Bearish