- AUD/NZD is moving in a tight range in the Asian session.

- Investors shrug off downbeat Australia’s balance of trade data.

- Overbought MACD warrants caution for more downside.

The AUD/NZD cross faces a strong hurdle around the 1.0795 mark and is now in efforts to extend the losses in the Asian session. The cross peaked at 1.0792 before it started consolidating in the trading range of 1.0775-1.0795.

At the time of writing, AUD/NZD is trading at 1.0776, down 0.06 on the day.

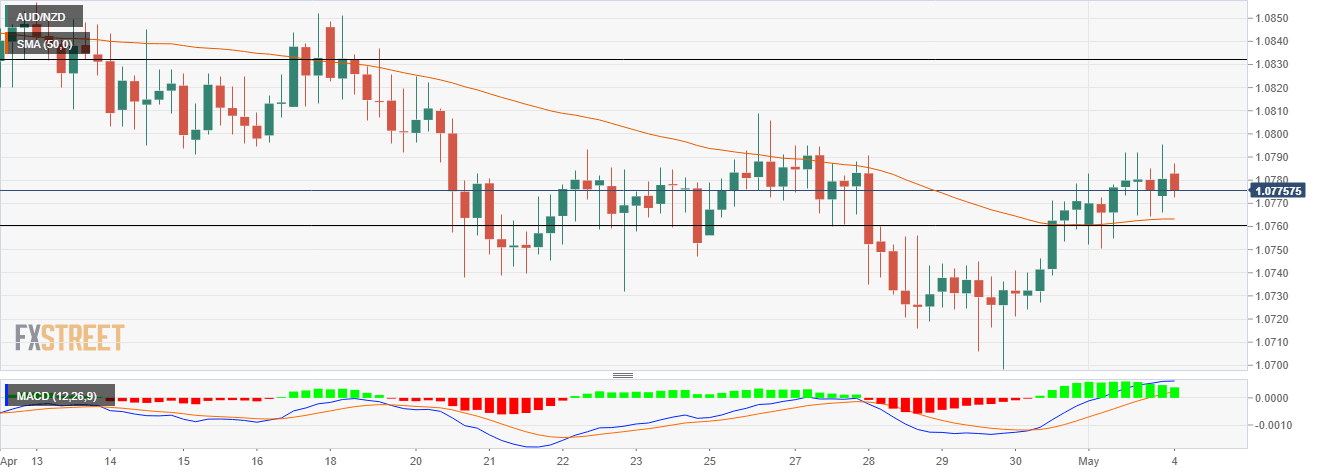

AUD/NZD four hourly chart:

On the four hourly chart, the cross is facing strong resistance in the vicinity of 1.0795. The mentioned level marks the multiple top formations where prices find it difficult to barge above and touch the 1.0800 key psychological level.

The Moving Average Convergence Divergence (MACD) indicator is in overbought trajectory, which signifies the stretched buying opportunities, Furthermore, any downtick would drag prices near Monday’s lows near 1.0765 followed by the 1.0760 horizontal support zone. The cross will accelerate the downward trend towards April 30 lows in the 1.0735 region.

On moving higher, prices would encounter first resistance near the 1.0790 mark, and then April 26 highs near the 1.0810 area. This would carve the path for the next target of 1.0830, the crucial horizontal area.