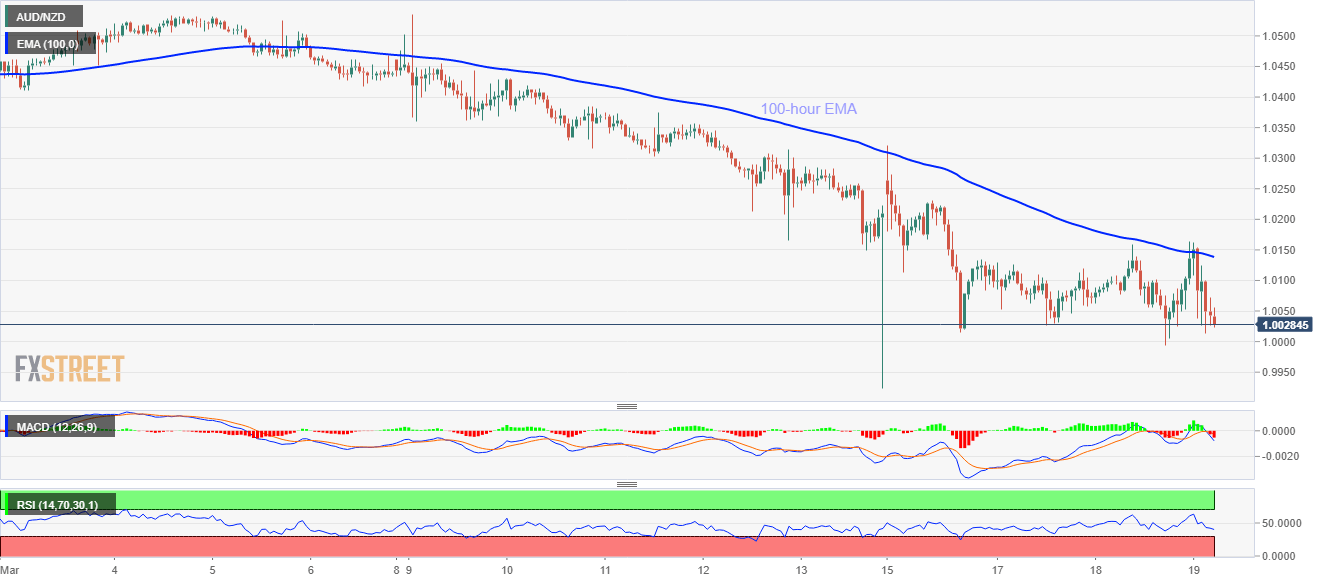

- AUD/NZD stays on the back foot below 100-hour EMA.

- Bears are less likely to relinquish control unless the quote recovers above August 2019 low.

While accelerating its previous declines, AUD/NZD drops to 1.0030, down 0.31%, after the RBA Governor marked the current timing as extra-ordinary during the early Thursday.

Read: RBA’s Lowe: Doing all that we can to lower funding costs in Australia and support the supply of credit to business

The pair currently drops towards the parity level while the previous day’s low near 0.9925 could offer additional rest to the bears.

On the upside, 100-hour EMA near 1.0140 acts as the immediate resistance, a break of which will trigger recovery moves targeting August 2019 low of 1.0260 and the weekly top surrounding 1.0320.

It should also be noted that the quote’s run-up past-1.0320 enables the buyers to aim for the monthly high close to 1.0535.

AUD/NZD hourly chart

Trend: Bearish