- AUD/NZD registers three-day winning streak, nears three-week high.

- The mixed outcome of the Australian data-dump couldn’t stop buyers from extending the short-term trend line breakout.

- Mid-January tops are on the buyers’ radar.

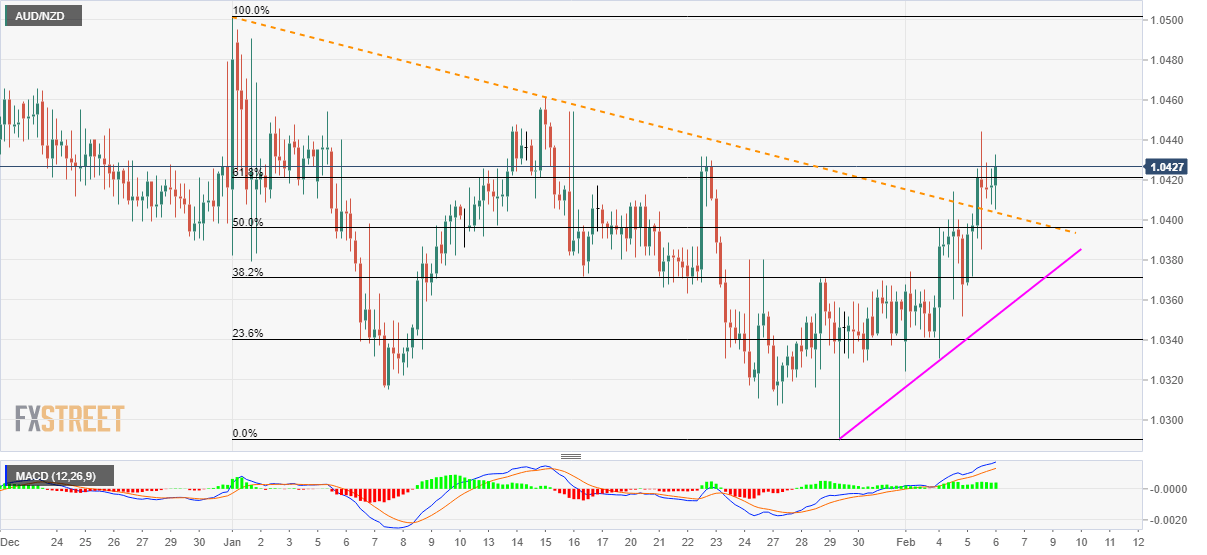

AUD/NZD takes the bids to 1.0430 following the release of Aussie data dump on early Thursday. The pair recently cleared 61.8% Fibonacci retracement of its January month declines after a successful break of the five-week-old falling trend line.

Read: Breaking: Aussie data dump sends AUD 10 pips up and down

Buyers currently target January 15 high near 1.0460 amid bullish MACD whereas the previous month top surrounding 1.0500 will lure the bulls afterward.

In a case where buyers manage to dominate past-1.0500, 200-day SMA on the daily chart, around 1.0550 will be in focus.

On the downside, the pair’s weakness below the resistance-turned-support line, near 1.0400, could recall 1.0370 support back to the chart.

Though an upward sloping trend line since January 29, at 1.0350, could challenge the bears past-1.0370, if not then January month’s bottom of 1.0290 may return to the charts.

AUD/NZD four-hour chart

Trend: Bullish