- AUD/NZD bounces off following New Zealand (NZ) Q4 GDP.

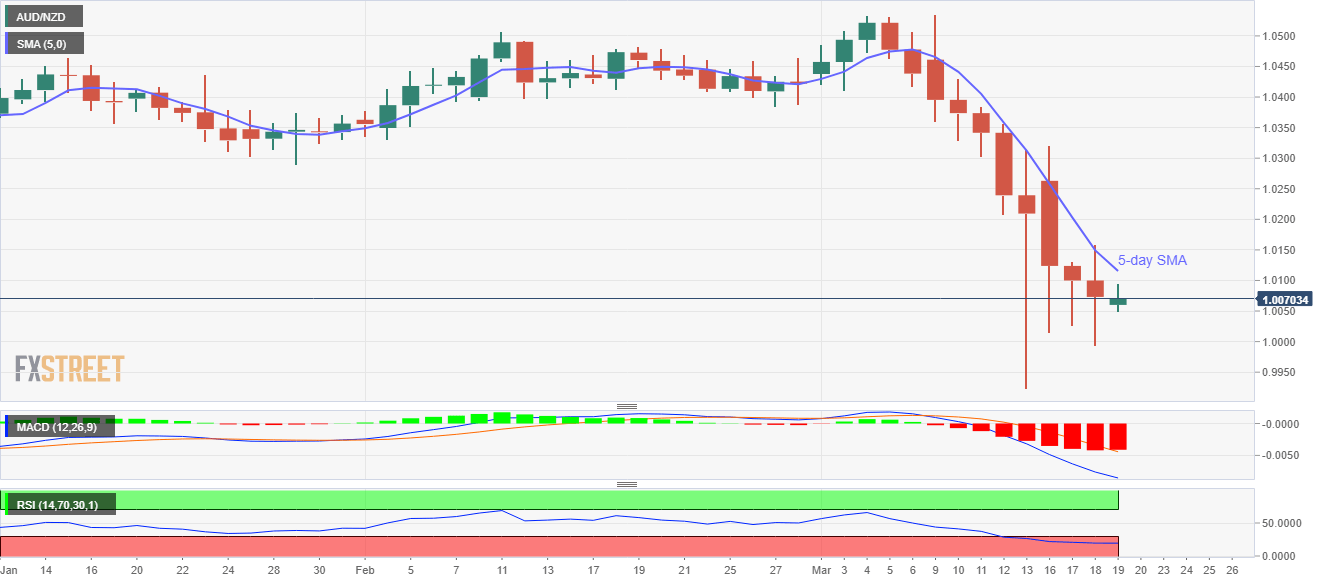

- 5-day SMA can offer immediate resistance ahead of March 2019 bottom.

- Sellers await entry below the parity level.

AUD/NZD consolidates losses to 1.0070 after New Zealand’s (NZ) fourth quarter (Q4) GDP release during the early Asian session on Thursday.

The Pacific nation’s economic growth matched wide market expectations, 0.5% QoQ and 1.8% YoY, while staying below the previous readouts.

Read: Breaking: New Zealand Q4 GDP: 0.5% QoQ (expected 0.5%, prior 0.7%)

Even if the news managed to trigger the pair’s pullback moves, the quote stays below the closest resistance of the 5-day SMA level, currently near 1.0115, which if broken can propel prices toward 1.0200 mark.

Should buyers concentrate more on the oversold RSI beyond 1.0200, January month low near 1.0290 will be on their radars.

Meanwhile, 1.0000 psychological magnet is the entry point for the new sellers targeting the recent lows near 0.9990 and 0.9925.

AUD/NZD daily chart

Trend: Bearish