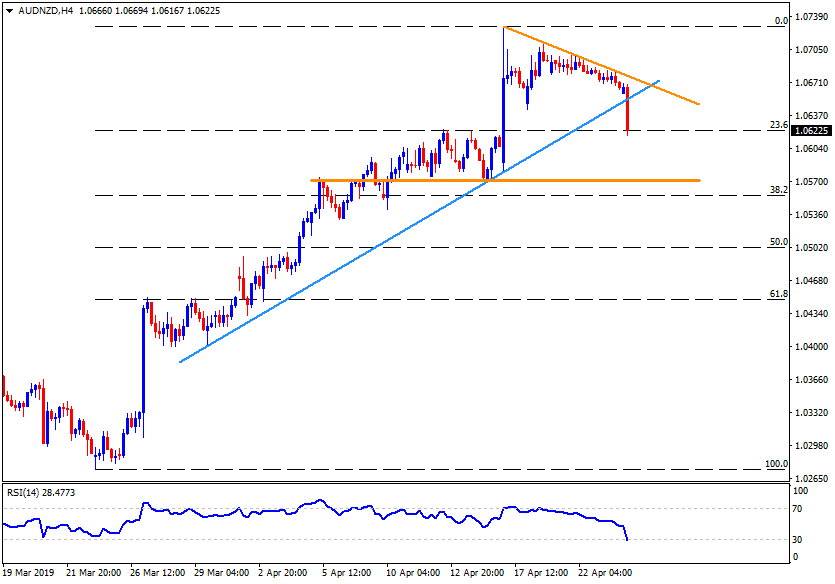

AUD/NZD trades around the lowest level in a week to 1.0630 during early Wednesday. The pair slipped beneath an upward sloping trend-line stretched since late-March after Australia’s headline inflation numbers, namely consumer prices index (CPI) and RBA trimmed mean CPI, lagged behind market consensus and prior readings.

In addition to breaking near-term support-line, the quote is also testing the 23.6% Fibonacci retracement of its March to April upside, at 1.0620, which if broken could further weaken the pair in direction to 1.0570 horizontal-line.

If prices keep trading southward under 1.0570, 1.0530 and 1.0500 are likely following numbers to appear on the chart.

During the reversal/pullback, 1.0640 and 1.0670 can be considered as nearby resistances whereas a weeklong descending trend-line at 1.0680 may challenge buyers then after.

Should there be increased buying pressure past-1.0680, 1.0700 and 1.0730 could become Bulls’ favorites.

AUD/NZD 4-Hour chart

Trend: Bearish