Last week saw a recovery in AUD on the back of stronger than expected Australian data and changing views on China’s economy. Australian building approvals and Q2 GDP came in better than expected earlier this week and the Chinese Manufacturing PMI of 51 is a 16-month high.

The latter resulted in an adjustment to the widely held view that China faces a severe slowdown. The short covering and repositioning on the back of last week’s positive data led AUD to break through the 9100 level as shown in the chart below.

View from the dealing floor.

Emiel Mahler works on IG’s dealing floor in Australia. To find out more about CFDs visit: https://www.ig.com/au

The chart shows that the positive trend continued this week as AUD opened above 9200 on the back of the Australian election result and strong Chinese trade balance figures over the weekend.

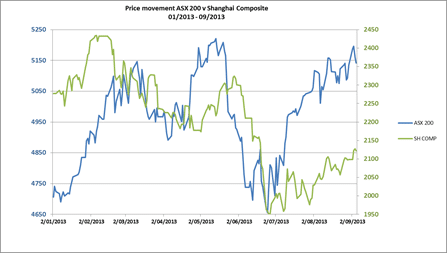

The recent debate around the ability of China to sustain high levels of economic growth has caused the Australian share market to move more closely in line with the Chinese share market as shown by the graph below.

The importance of the Chinese economy for AUD and the Australian share market can be explained by the fact roughly 30% of Australian exports go to China. Given the difficulty of trading Chinese shares, another reason for the correlation is that trading Australian shares is a way for offshore investors to express their view on China.

Looking ahead, with China’s economy being one of the main themes at the moment, the question whether AUD can continue its recovery very much depends on whether the recent pick up in Chinese Manufacturing PMI and Trade Balance is sustained. Continuing worries about China’s rising debt and inefficient (local) government spending disrupting the economy could lead to a reversal of the recent change in sentiment.

This week is data heavy as Chinese Money Supply, Industrial Production and Retail Sales are all key indicators that are due to be released. In combination with the closely watched Australian unemployment figures on Thursday, this could make for a volatile week for AUD.

This information has been prepared by IG Markets Limited. ABN 84 099 019 851, AFSL 220440. We provide an execution-only service. The material on this page does not contain (and should not be construed as containing) personal financial or investment advice or other recommendations, or an offer of, or solicitation for, a transaction in any financial instrument, or a record of our trading prices. No representation or warranty is given as to the accuracy or completeness of the information. Consequently any person acting on it does so entirely at his or her own risk. The information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who view it. IG accepts no responsibility for any use that may be made of the comments and for any consequences that result.