The Australian dollar enjoyed a nice recovery and hit 0.79. This was due a variety of reasons. Is this a change in course?

The team at Credit Agricole does not think so and explains:

Here is their view, courtesy of eFXnews:

Ongoing rates pressures argue it’s soon for a rebound. Even if February inflation expectations improve next week, investors are unlikely to rush back into AUD.

Softening domestic data, and ongoing concerns surrounding a further contraction in external demand are tempering AUD enthusiasm. Indeed as we’ve highlighted previously, weak bulks (e.g. Iron Ore and Coal) prices could remain a drag upon the trade and hence foreign direct investment for the entirety of 2015.

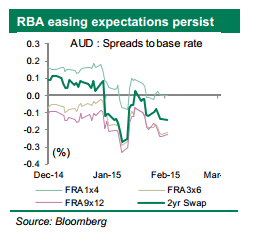

Such concerns were highlighted by the RBA in its latest policy statement alongside the still constraining influence of a high AUD upon the terms of trade. Undoubtedly this combination of factors are behind the recent shift market pricing looking for yet another 0.25% cut in benchmark interest rates.

While this RBA pricing may prove dovishly optimistic, such expectations should be sufficient to at least cap AUD/USD this week.

We remain short AUD/NZD and look to sell rallies

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.