- AUD is bid despite the holiday thin markets and traders await the RBA.

- AUD/USD bears looking to break the daily support structure.

AUD is higher against G10 currencies by about 0.3%, and to the dollar, it is rising by 0.38% at the time of writing having travelled from a low of 0.7700 to a high of 0.7741 so far.

The markets are thin during holiday trade on Monday and ahead of tomorrow’s (likely uneventful) Reserve Bank of Australia policy decision.

The RBA is expected to stick to a dovish stance considering the resurgence of Covid-19 cases in Melbourne.

Meanwhile, there has not been a great deal of new information for the bank to go on and the pivotal July meeting should garner more attention.

The April jobs data showed a slowdown in total employment but the Aussie caught a bid due to the reduction in the unemployment rate (to 5.5%), albeit thanks to a smaller participation rate.

Meanwhile, some geopolitical tension between Australia and China is also going to be a concern for the RBA and will hinder investment flows into the currency due to the uncertainties.

”We think dips in the antipodes are temporary, and we hold a tactical bullish bias in the coming weeks as we think focus will remain on the hawkish pivots of central banks,” analysts at TD Securities said.

As for China, Australia’s largest trade partner, data overnight was bullish overall despite the slight decline in the manufacturing PMI.

Investors may prefer to focus on the expansion for 13 straight months as well as the increase in the services PMI.

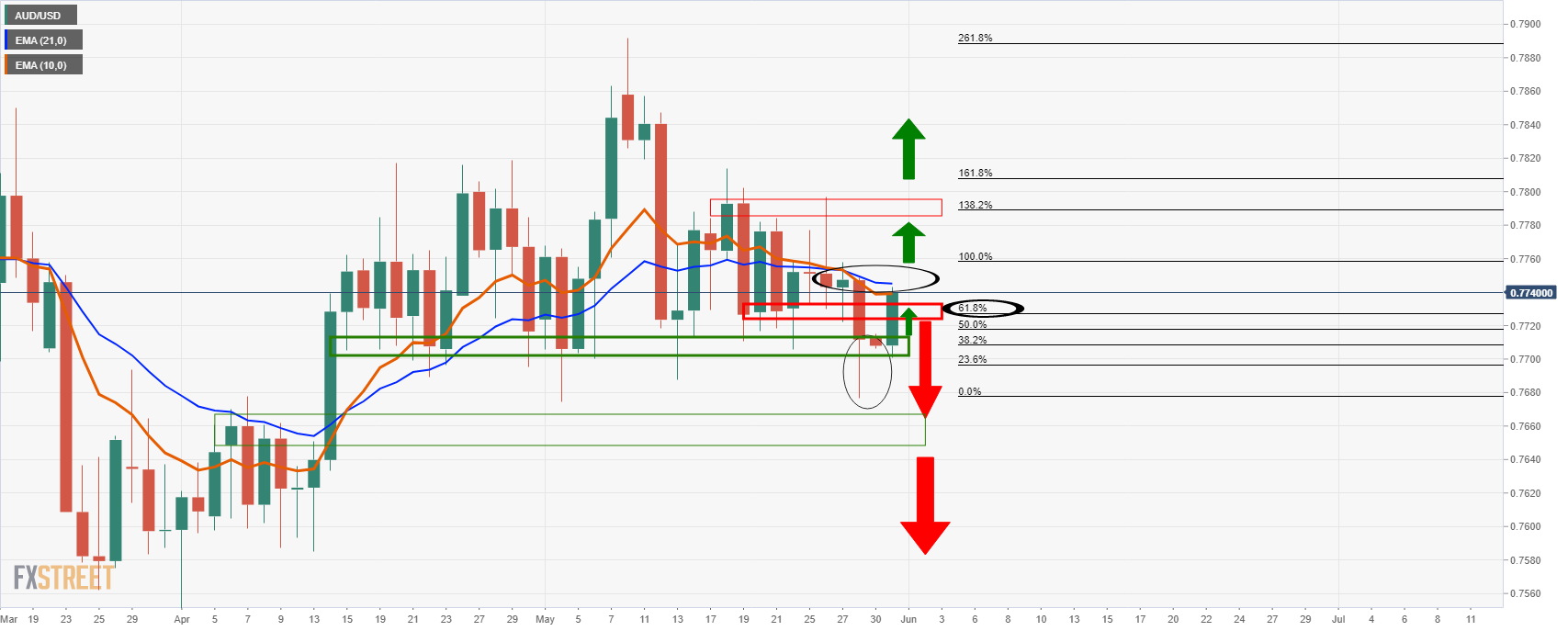

AUD/USD technical analysis

We have seen a firmer test of the M-formation’s resistance as follows:

The price has even surpassed the 61.8% Fibonacci but has so far tested the 78.6% Fibonacci resistance and the confluence with the 27 May high liquidity candle, which too would be expected to act as resistance.

Consequently, there are downside risks and the potential of a fresh daily bearish impulse to crack the current daily support structure.