- The aussie finds respite from a rebound in the S&P 500 futures.

- Falling Treasury yields lift the market mood, cap the gains in the DXY.

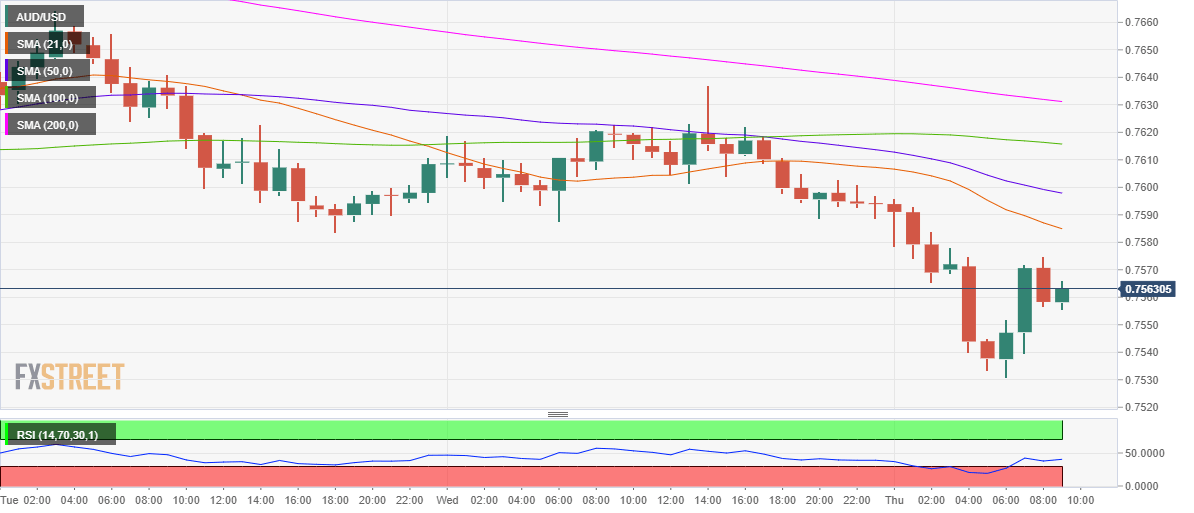

- 21-HMA offers immediate resistance while sellers remain hopefully.

AUD/USD is attempting a bounce above 0.7550 in the European session, having reached the lowest levels in four months at 0.7531 earlier on.

The recovery in the aussie could be attributed to the improved market mood amid strong Euro area Manufacturing PMI reports and falling Treasury yields. This is reflective of the 0.38% uptick in the S&P 500 futures.

The negative sentiment around the US rates makes the aussie dollar more attractive as an alternative higher-yielding asset. The renewed buying interest in oil and gold prices also offer support to the commodities-linked aussie.

Markets now await the US ISM Manufacturing release for fresh trading impetus, as the unexpected drop in the Chinese Caixin Manufacturing PMI could likely remain a drag on the AUD.

AUD/USD: Technical Outlook

From a near-term technical perspective, the spot is looking to recapture the bearish 21-hourly moving average (HMA) at 0.7585 on the road to recovery.

The Relative Strength Index (RSI) has also rebounded from lows and points higher, as of writing, suggesting that there remains scope for additional recovery.

The next stop for the aussie bulls is seen at the 50-HMA of 0.7598, above which the 100-HMA at 0.7616 could be challenged.

AUD/USD: One-hour chart

Meanwhile, should the spot face rejection at the 21-HMA then a drop back towards the multi-month lows cannot be ruled.

Further south, the 0.7500 threshold could come to the buyers’ rescue.

AUD/USD: Additional levels