- AUD/USD grounded and then elevated again on the Fed’s tapering timings.

- The presser has fuelled the bid again in the Aussie, but there are questions over how far AUD bulls can run.

The two-day meeting was concluding with the Federal Reserve’s interest rate decision, monetary policy announcements, statement and the Fed’s chair’s presser.

The Fed noted near-term downside risks, but it seems that they have not been enough for a case for WAM extension which is what the market had been expecting.

An extension would bull flatten the curve and likely weigh on the greenback, but the bears were not entirely satisfied with today’s outcome, supporting the US dollar from falling over the edge and capping the Aussie below cycle highs.

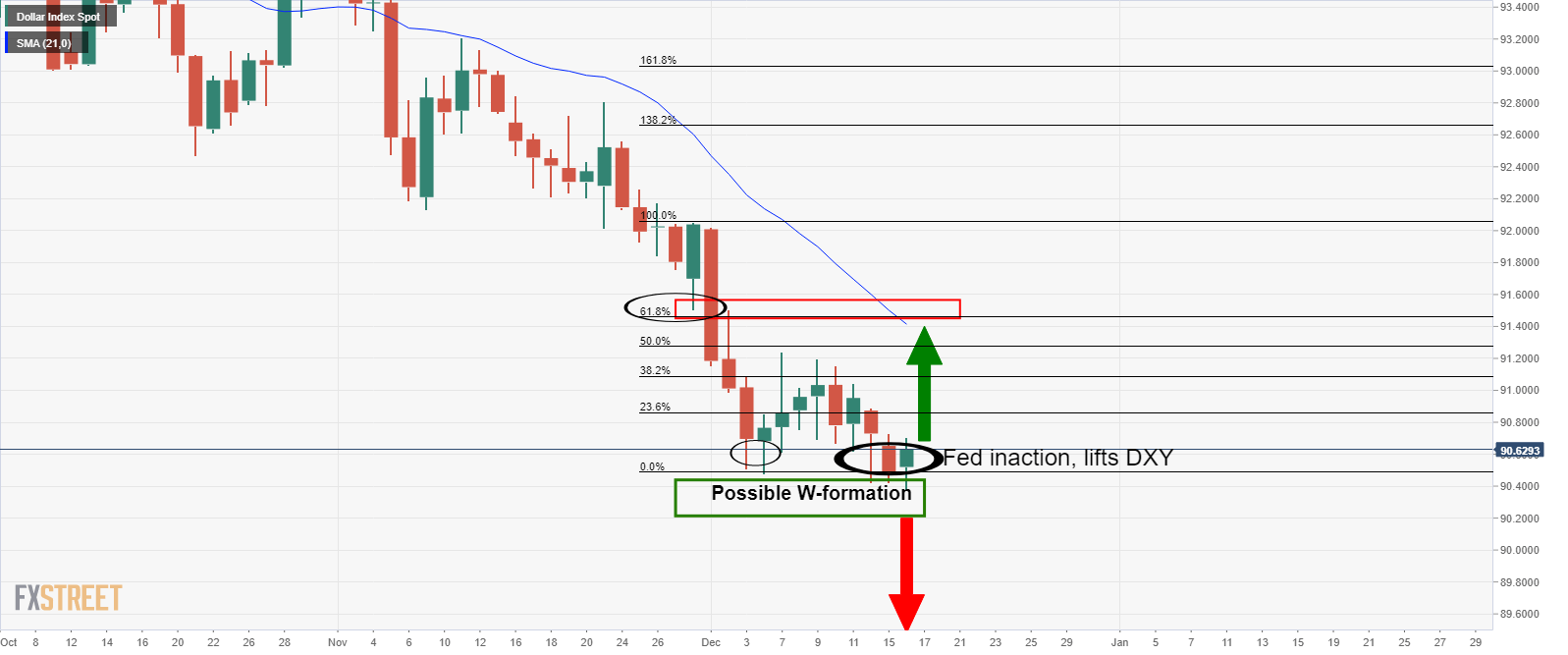

DXY daily chart

Here we have the makings of a W-formation pattern.

Bulls could target the 21-day moving average and confluence with prior support structure and a full 61.8% Fibonacci retracement.

Key FOMC takeaways, so far

- US Fede holds benchmark interest rate unchanged at 0% to 0.25%.

- Target range stands at 0.00% – 0.25% .

- The interest rate on excess reserves unchanged at 0.10%.

- Dot plot at end of 2023 remains at zero.

- Will continue pace of bond buys until ‘substantial’ progress on goals.

- Will continue to buy $80b/month in treasuries and $40b/month in MBS.

- Will continue bond buys “until substantial further progress has been made toward the committee’s maximum employment and price stability goals.”

- Repeats that “the ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term”.

- Fed sees US GDP down 2.4% in 2020, up 4.2% in 2021 and up 3.2% in 2022.

- Fed sees unemployment rate at 6.7% in 2020, 5% in 2021 and 4.2% in 2022.

The outcome of the announcements was slightly less dovish than expected.

The lifeline for the US dollar bulls arrived in the statement where it stated that it will taper after “substantial progress” but will keep policy “accommodative” until they “achieve inflation moderately above 2 per cent for some time,” is what has investors recalibrating their portfolios.

However, the presser has seen a reversal in the greenback as the Fed’s Chair Powell has clarified that the Fed’s tapering is some way off. ”We will continue to provide powerful support until the recovery is complete.”

So, the presser has reinforced the status quo, which should continue to support the high betas trading in confluence within a risk-on environment marked by expectations that the Fed will continue to use its balance sheet to support the economy.

Therefore, we can expect the USD to remain pressured whereby the high betas, such as the Aussie, can continue to thrive.

That being said, analysts at Rabobank argued that ”bulls should beware of the potential pitfalls facing the AUD.”

”Yesterday’s sour tone in the AUD was also likely a function of headlines suggesting a worsening of trade tensions with China.”

Moreover, the analysts explained that ”for its part, the RBA is not taking any chances with the economic recovery. In an environment already marked by the slowest pace of wage growth in the two-decade history of the series, the RBA has stated that it does not expect to increase the Cash rate for at least 3 years.”

”We suspect upside potential will be tempered. Our 12-month forecast stands not far from current levels at AUD/USD 0.76.”