The Australian dollar fell sharply, reaching the lowest levels since December. Has it bottomed out? A busy week sees the RBA dominating the scene. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australian inflation disappointed with a rise of only 0.4% q/q on the headline and 0.5% on the core. This may keep the RBA from moving. In the US, 10-year yields crossed the 3% threshold, spurring a dollar shopping spree. US GDP beat expectations with an annualized rate of 2.3%.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

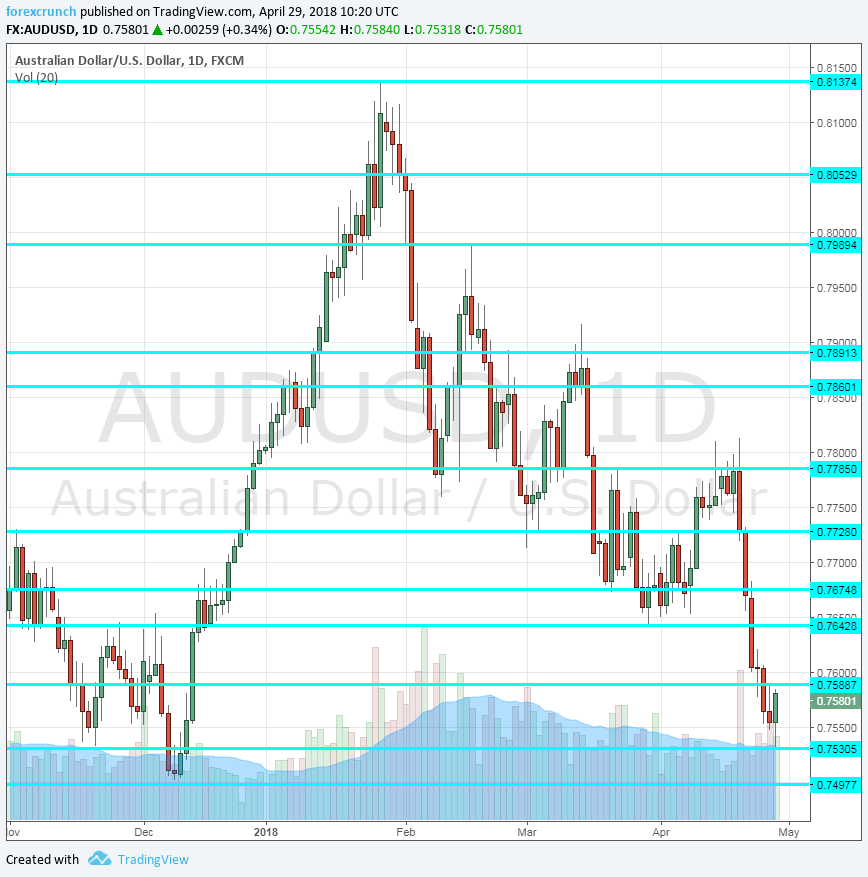

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- MI Inflation Gauge: Monday, 1:00. The Melbourne Institute provides information about inflation as the government releases CPI data only once per quarter. A rise of 0.1% was recorded in March and a similar figure could be seen in April.

- Chinese Manufacturing PMI: Monday, early morning. The official gauge of the manufacturing sector has shown modest growth in March with a score of 51.5 points. A minor drop to 51.3 is projected. The official Chinese government measure uses different data than the independent Caixin one.

- Private Sector Credit: Monday, 1:30. Credit growth reflects wider growth in the economy. After a rise of 0.4% in February, the same increase is expected for March.

- Phillip Lowe talks: Monday, time unknown. Just before the rate decision, the Governor of the RBA will speak in Adelaide at a dinner organized by the Bank. He will likely refrain from saying anything directly related to monetary policy so close to the event.

- AIG Manufacturing Index: Monday, 22:30. The Australian Industry Group’s survey of 200 manufacturers showed a whopping jump in the indicator to 63.1 points, above the previous range and reflecting robust growth. A drop may be seen this time.

- Rate decision: Tuesday, 4:30. The Reserve Bank of Australia is expected to leave the interest rate unchanged at 1.50% once again. The institution led by Governor Phillip Lowe has not changed the rates since 2016 and has said it is firmly on hold for the time being. The RBA will likely be delighted with the recent slide in the A$ but disappointed with the unimpressive quarterly inflation and the not-so-great jobs report. The message may be somewhat more concerned, but a rate cut is not on the cards.

- Commodity Prices: Tuesday, 6:30. Australia is an exporter of commodities, making this indicator important. However, the daily fluctuations in the prices of iron and copper have a more significant impact than this measure. The gauge fell by 2.1% y/y in March and may show an upswing this time.

- Chinese Caixin Manufacturing PMI: Wednesday, 1:45. This independent 430-strong survey of the world’s No. 2 economy’s manufacturing sector stood at 51 points in March and is now expected to rise to 51.6 points. Australia relies on exports to China.

- AIG Services Index: Wednesday, 22:30. Contrary to the manufacturing sector, manufacturing still shows solid, yet not extraordinary growth with 56.9 points in March. A small rise may be seen now.

- Trade Balance: Thursday, 1:30. Australia enjoyed a trade surplus of 830 million A$ in February. A widening of the surplus is on the cards for March: 950 million.

- Building Approvals: Thursday, 1:30. This measure of the housing sector is quite volatile but still provides important information. After a drop of 6.2% in February, a correction of 1.1% is on the cards for March.

- RBA Monetary Policy Statement: Friday, 1:30. The RBA will have the last word of the week with its quarterly report. In some cases, a nondescript rate statement was later followed by more revealing and market-moving information in this publication. An outlook on inflation may provide clues to the next moves by the Bank.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD dropped sharply early on and was able to catch a breath only toward the end of the week.

Technical lines from top to bottom:

0.7890 worked as support in February and resistance in October. 0.7810 was a swing high in mid-April.

0.7730 capped the pair in early April. 0.7675 served as a line of support in mid-March.

Lower, 0.7640 was a trough in late March. 0.7590 capped the pair when it attempted a recovery late in April. 0.7530 was the low point around the same time.

The round 0.75 level which is where the began its ascent in December is a key level of support. Further down 0.7410 was a cushion back in 2017.

I remain bearish on AUD/USD

A neutral to a dovish RBA contrasts the Federal Reserve. After the small correction on Friday, the pair could resume its falls.

Our latest podcast is titled Is inflation rearing its ugly head? Oil is on fire

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!