The Australian dollar fell sharply on a mix of dovish RBA report and on the Turkish crisis that became global. What’s next? Australia’s jobs report is in the limelight. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Reserve Bank of Australia left the interest rate unchanged as expected but hit the Aussie later in the week with a relatively dovish outlook. The doubts about inflation were joined by a risk-off sentiment that engulfed markets as the fall of the Turkish Lira could have implications for the euro-zone and the global economy. Trade tensions between the US and China did not help either for the Aussie dollar that dropped to the lowest levels since January 2017.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

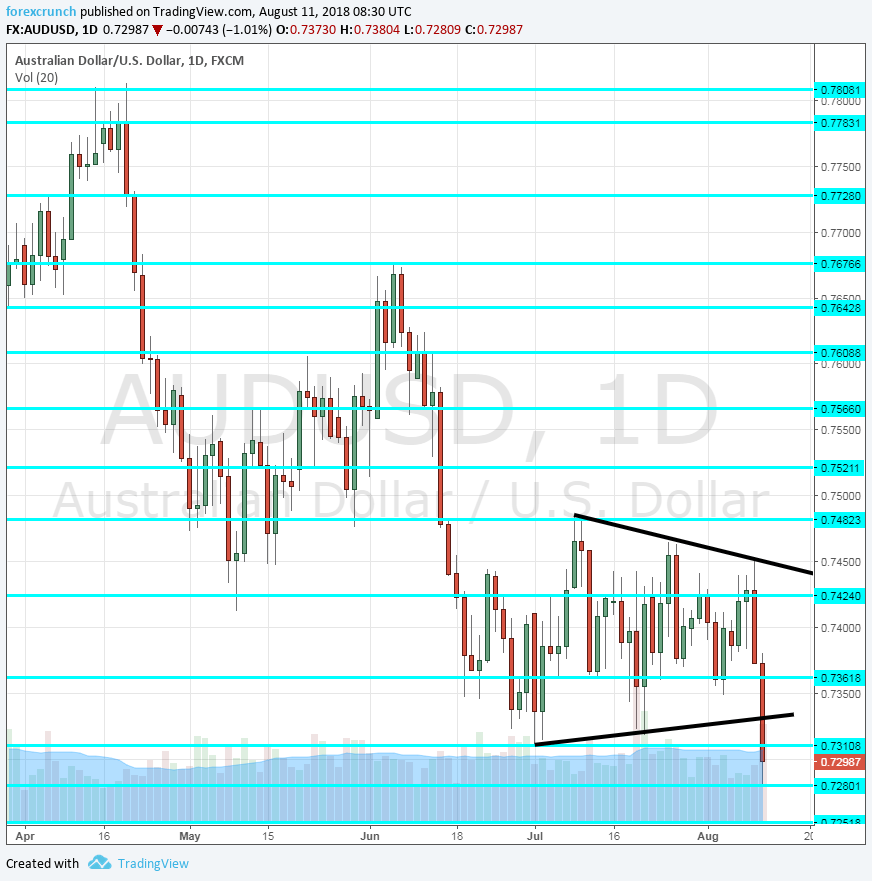

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- NAB Business Confidence: Tuesday, 1:30. This monthly report from the National Australian Bank dropped to 6 points back in June, but remains positive, indicating improving economic conditions. A similar figure is likely in the 350-strong survey for July.

- Chinese Industrial Production: Tuesday, 2:00. China is Australia’s No. 1 trading partner. Industrial output rose at an annual pace of 6% in June and is now projected to rise by 6.3%. Increased output implies more metal imports from Australia.

- Westpac Consumer Sentiment: Wednesday, 00:30. Consumer sentiment increased by 3.9% in June according to the survey of 1,200 Australian consumers. This big increase is unlikely to be repeated in July.

- Wage Price Index: Wednesday, 1:30. Wages are becoming important all over the world and this official quarterly report is gaining traction. Salaries increased by 0.5% in Q1 2018, slightly below expectations. A quicker rise of 0.6% is on the cards now.

- MI Inflation Expectations: Thursday, 1:00. The authorities publish official inflation figures only once per quarter. This publication from the Melbourne Institute fills the gap. Expectations increased by 3.9% in June. A similar figure is likely for July.

- Jobs report Thursday, 1:30. Australia enjoyed a significant gain in jobs in June: 50.9K. This included 41.2K full-time jobs gained and 9.7K part-time jobs, a good composition. The unemployment rate stood at a healthy 5.4% with a participation rate of 65.7%. A more modest gain in jobs is likely now: 15.3K is on the cards. The jobless rate is expected to remain unchanged at 5.4%.

- Phillip Lowe talks: Thursday, 23:30. The Governor of the RBA will testify in Canberra. He will speak about a broad range of topics and may provide more hints about future monetary policy. Comments about trade will be of special interest.

- Luci Ellis talks: Friday, 7:30. The RBA Assistant Governor will talk in Canberra and may add some information to the testimony of Lowe.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD continued trading in the narrowing wedge before tumbling down and falling below 0.73.

Technical lines from top to bottom:

0.7640 was a stubborn cushion in March and April. The fall below this line proved its strength. 0.7610 was the peak of an upwards move in late May.

0.7560 is the next level to watch after it was the recovery level in early May. 0.7520 was a swing low in late May.

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July.

0.7310 is the low of July 2018. The new 2018 low at 0.7280 is the next level to watch.

0.7250 served as a pivotal line in early 2017 and the last line to watch is 0.7160 that was the swing low back then.

Narrowing Wedge Broken

As the chart shows, the pair was trading within a narrowing wedge, or triangle. The break to the downside is a dovish sign.

I am bearish on AUD/USD

Ongoing trade wars and a dovish central bank are a recipe for further falls.

Our latest podcast is titled Brexit summer blues, trade troubles

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!