- NAB Business Confidence: Monday, 21:30. Business confidence evaporated in March, as the National Australia Bank indicator plunged to -66 points. This points to sharp pessimism about economic conditions. Will we see any improvement in the April data?

- Westpac Consumer Sentiment: Tuesday, 20:30. Consumer confidence nosedived in April, with a dismal reading of -17.7 percent. Consumers are clearly worried as the economy buckles under the strain of Covid-19 and are holding tightly to their purse strings.

- Wage Price Index: Tuesday, 21:30. Wage growth is one of the most important employment indicators. The index rose by 0.5% in Q4 of 2019 and an identical gain is projected for Q1 of 2020.

- MI Inflation Expectations: Wednesday, 21:00. This Melbourne Institute indicator is closely watched, as inflation expectations can translate into actual inflation figures. The indicator climbed 4.6% in March, up from 4.0% in the previous release. We now await the March data.

- Australian Jobs Report: Thursday, 1:30. Analysts are bracing for disastrous job numbers for April, as the lockdown has left millions of employees unable to work. The economy is expected to shed a staggering 550 thousand jobs, while the unemployment rate, which came in at 5.2% in March, is expected to soar to 8.3 percent. If the employment numbers are within expectations, the Aussie will likely lose ground.

.

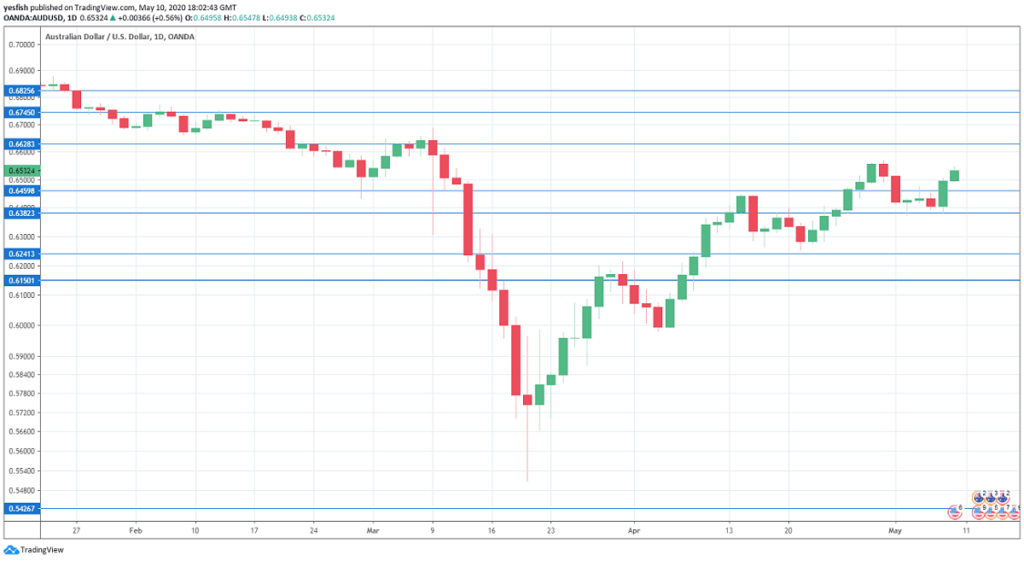

AUD/USD Technical Analysis

Technical lines from top to bottom:

0.6825 supported the pair in late 2016 and early 2017.

0.6744 was a low point in January.

0.6627 has held in resistance since early March. 0.6560 is next.

0.6456 remains relevant and is the next resistance line.

0.6380 (mentioned last week) is an immediate support level. It could see further action early in the week.

0.6240 is next.

0.6150, which has provided support since early April, is the final support level for now.

.