AUD/USD posted a strong gain for a second straight week. The pair gained 1.0% last week and punched above the 0.72 level. The upcoming week has three events, including Employment Change. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

The Melbourne Institute Inflation gauge posted a small gain of 0.1% for a second successive month. The National Australia Bank Business Confidence index improved to -4, up from -8 points. The RBA maintained rates at 0.25%, where they have been pegged since Mach. However, the bank hinted broadly that it would cut rates at the November meeting.

In the US, the ISM Services PMI improved to 57.8, up from 56.9 points. The indicator is well into expansionary territory, above the neutral 50-level. The FOMC minutes expressed concern that the lack of a federal fiscal stimulus package could hinder the US recovery, which members said was moving faster than expected. A stimulus bill has been stuck in Congress and it is unlikely that a deal will be reached before the US election. The US dollar showed little reaction to the minutes, as policymakers did not provide any forward guidance on interest rate hikes.

- Westpac Consumer Sentiment: Tuesday, 23:30. Consumer confidence rebounded in September, with a gain of 18.0% after two straight declines. Will we see another strong gain in October?

- MI Inflation Expectations: Thursday, 00:00. The Melbourne Institute indicator slowed to 3.1% in August, down from 3.3%. This was the lowest level since 2015. We now await the September data.

- Employment Report: Thursday, 00:30. The economy created 111.0 thousand jobs in August, blowing past the estimate of -40.0 thousand. However, the forecast for September stands at -35.0 thousand. The unemployment rate is projected to rise to 7.1% up from 6.8%.

.

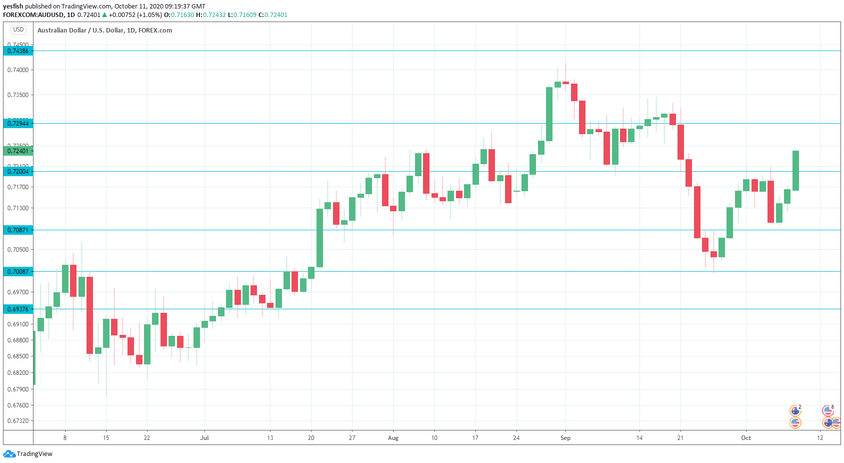

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7513. This line has held since June 2018.

0.7438 is an important monthly resistance line.

0.7294 (mentioned last week) is next.

The round number of 0.7200 switched to a support role after strong gains by AUD/USD last week.

0.7087 is next.

0.7008 is protecting the symbolic 0.7000 line.

0.6937 has provided support since mid-July. It is the final support level for now.

I remain bearish on AUD/USD

With the RBA likely to lower rates before the end of the year, sentiment towards the Aussie could weaken. As well, the September job report is projected to show a decline, which could send the Australian dollar to lower levels.

.

Follow us on Sticher or iTunes

Further reading:

Safe trading!