- The Aussie is grasping towards the 0.74 handle as markets head into Friday with a note of Greenback selling.

- US Markit PMIs will cap off the economic calendar for the week.

The AUD/USD is clipping into the 0.74000 key level as the US Dollar continues to step down in broader markets as risk appetite recovers for the final Friday sessions.

The Aussie continues to capitalize on the Greenback’s newfound weakness in the fx markets against the wider currency bloc, as a risk sentiment recovery coupled with US Treasury yields also walking back from their recent perch is dragging the USD further down the charts as markets round the corner into the last day of the trading week.

The AUD has clocked out for the weekend on the economic calendar, but the upcoming US session sees Markit PMIs for the US dropping at 13:45 GMT, with the Markit Composite PMI slated to come in at 55.1, versus the previous reading of 56.6.

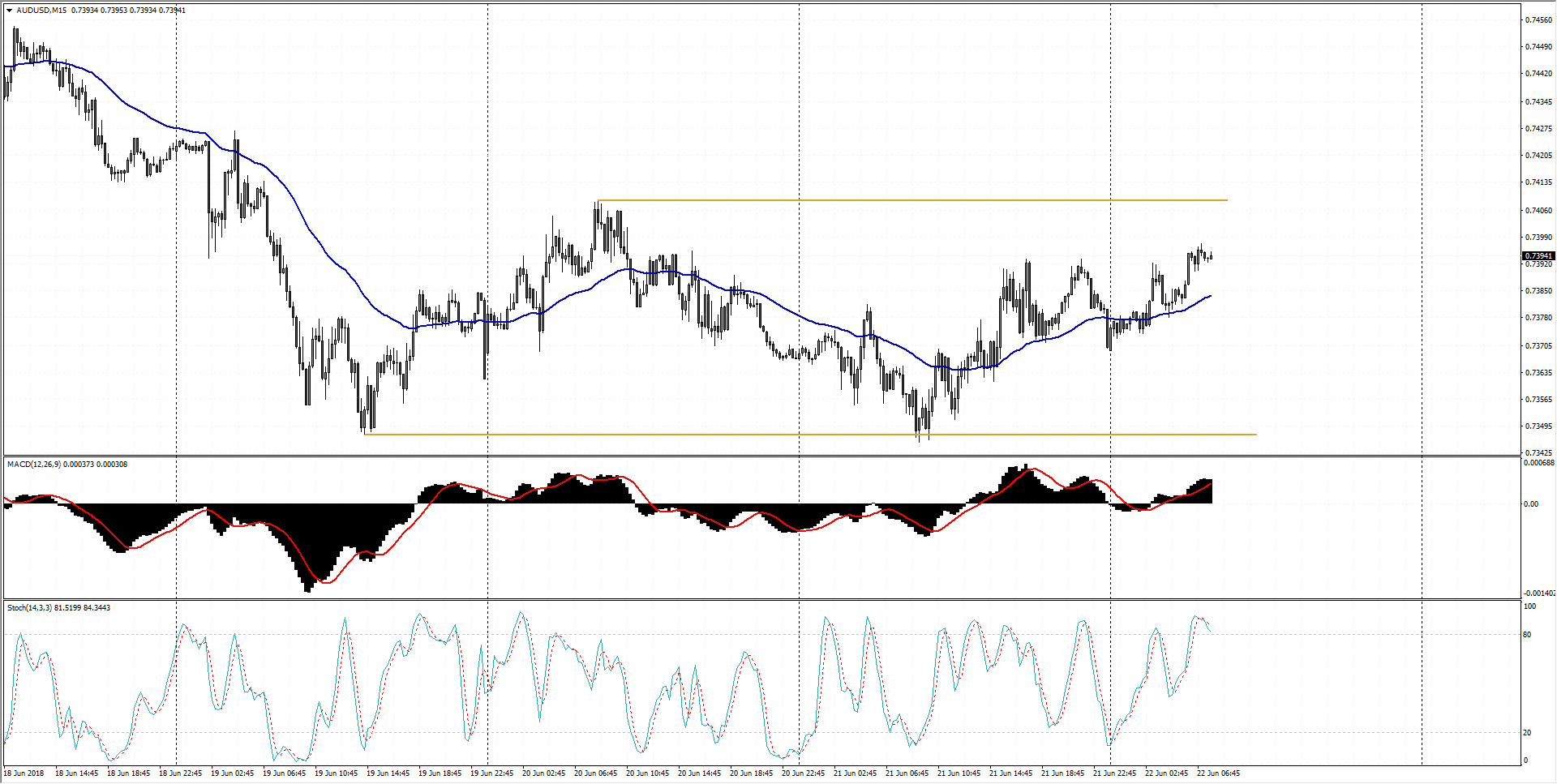

AUD/USD Technical analysis

With the AUD/USD double-bottoming off of a key level from May 2017, today’s bullish momentum is being fueled less by Aussie buying and more by a walkback in broader markets by the US Dollar, and a Dollar recovery could easily ruin AUD bullish potential.

AUD/USD Chart, 15-Minute

Spot rate: 0.7394

Relative change: 0.26%

High: 0.7397

Low: 0.7369

Trend: Flat

Support 1: 0.7369 (current day low)

Support 2: 0.7347 (key support; double bounce region)

Support 3: 0.7315 (161.8% Fibo level)

Resistance 1: 0.7408 (June 20th swing high)

Resistance 2: 0.7450 (R3 daily pivot)

Resistance 3: 0.7483 (23.6% weekly Fibo level)