- AUD/USD takes the bids near intraday high of 0.7641.

- Sydney rings emergency alerts as second cluster of covid emerges, US marked the first case of covid variant.

- US policymakers jostle over $2,000 paycheck, China revised down 2019 GDP.

- China up for releasing two of 12 detained Hong Kong activists.

AUD/USD crosses the multi-month high, flashed earlier in the month, while taking bids near 0.7641, up 0.42% intraday, during early Wednesday. While refreshing the day’s high, the Aussie pair challenges the 0.7640 key resistance even as US policymakers jostle with the coronavirus (COVID-19) aid package while the virus recently troubled the US, Japan and Australia.

Following US Senate Republican Majority Leader Mitch McConnell obstructed the $2,000 paycheck, Congress members are trying to delay the voting over the much-awaited stimulus unless they win a runoff in Georgia, as per the latest chatters. However, US Treasury Secretary Steve Mnuchin’s statement suggesting $600 relief will be out tonight seems to have favored the risks.

Also on the risk-negative side could be the news suggesting Colorado’s first in the US case of the covid variant found by the UK. The issue becomes worrisome as the infected doesn’t have any travel history. Furthermore, Sydney also raises emergency amid the second wave of the virus while Japan increased barriers for international visitors.

Talking about positives, China shows readiness to return two Hong Kong activists, out of 12, detained over illegal border crossing, per the Global Times. It should also be noted that the People’s Bank of China’s (PBOC) readiness to ease further combats the downbeat economic analysis from China’s National Bureau of Statistics to challenge the mood.

Amid these plays, S&P 500 Futures rise 0.23% while stocks in Australia and Japan are mildly offered off-late.

Looking forward, updates for the US stimulus and the virus news will be the key ahead of the US session when the second-tier activity and housing data will challenge the sentiment. If the US dollar index (DXY) refreshes the lowest since April 2018 following the American news and risk tone, AUD/USD is up for challenging the June 2018 top near 0.7675.

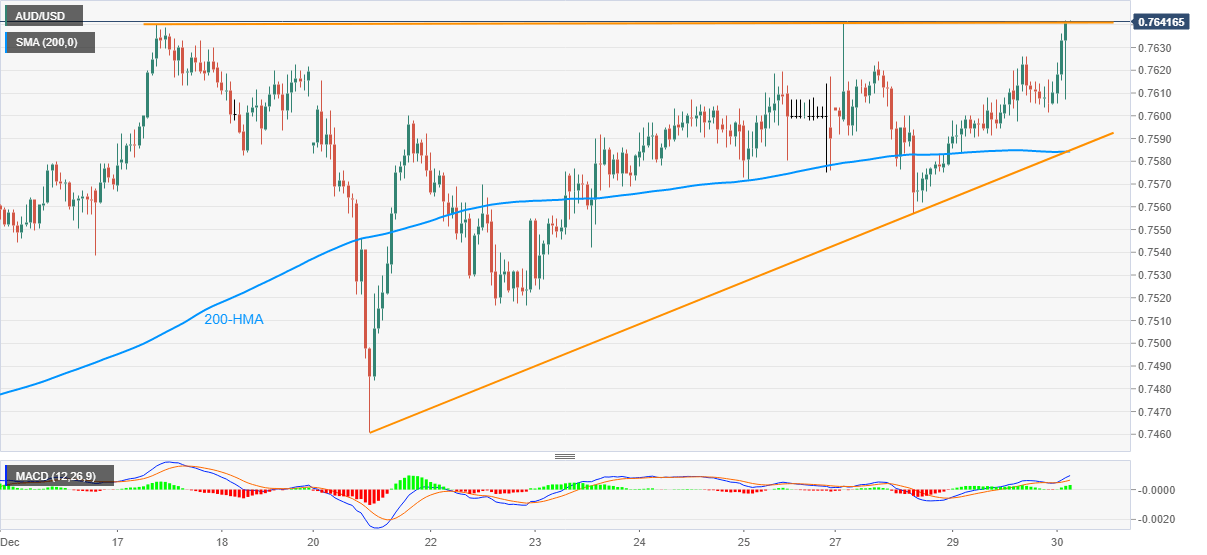

Technical analysis

Unless breaking below 200-HMA and an upward sloping trend line from December 21, around 0.7585, AUD/USD bulls can keep the reins.