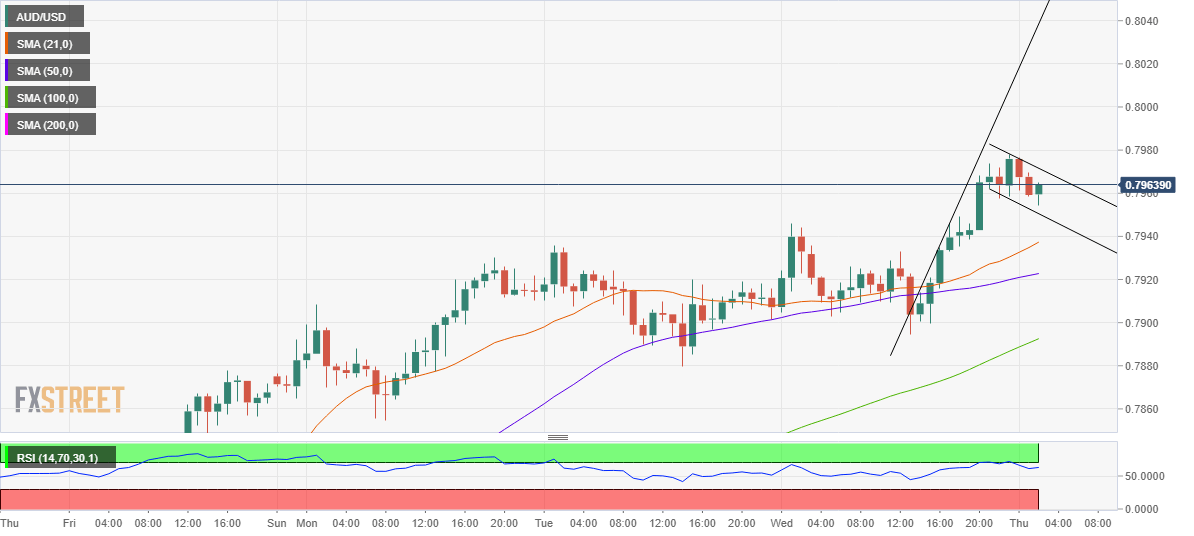

- AUD/USD awaits confirmation on a bull flag breakout on the 1H chart.

- RSI stays bullish while the aussie trades above major hourly averages.

- The AUD bulls will continue to benefit from the reflation trade theme.

After Wednesday’s rally, AUD/USD has entered a phase of consolidation near three-year highs of 0.7978.

Despite a minor pullback, the sentiment around the aussie remains buoyed by the reflation trade, thanks to the stimulus and vaccine-driven hopes of a swift economic rebound.

Further, the advance across the commodities space and upbeat Australian Q4 Private Capex data also provide support to the aussie bulls.

Looking at the hourly technical graph, the recent surge that followed a consolidation has carved a bull flag formation.

An upside break is likely to be confirmed on an hourly closing above the falling trendline resistance at 0.7972.

Further up, the 0.8000 threshold could be tested, as the Relative Strength Index holds firmer above the midline and supports the move higher.

The bulls will then aim for the measured pattern target around 0.8050 levels.

To the downside, a breach of the falling trendline support at 0.7950 could invalidate the bullish formation, as the correction could extend towards the 21-hourly moving average (HMA) at 0.7938.

Overall, the path of least resistance appears to the north.

AUD/USD: Hourly chart

AUD/USD: Additional levels