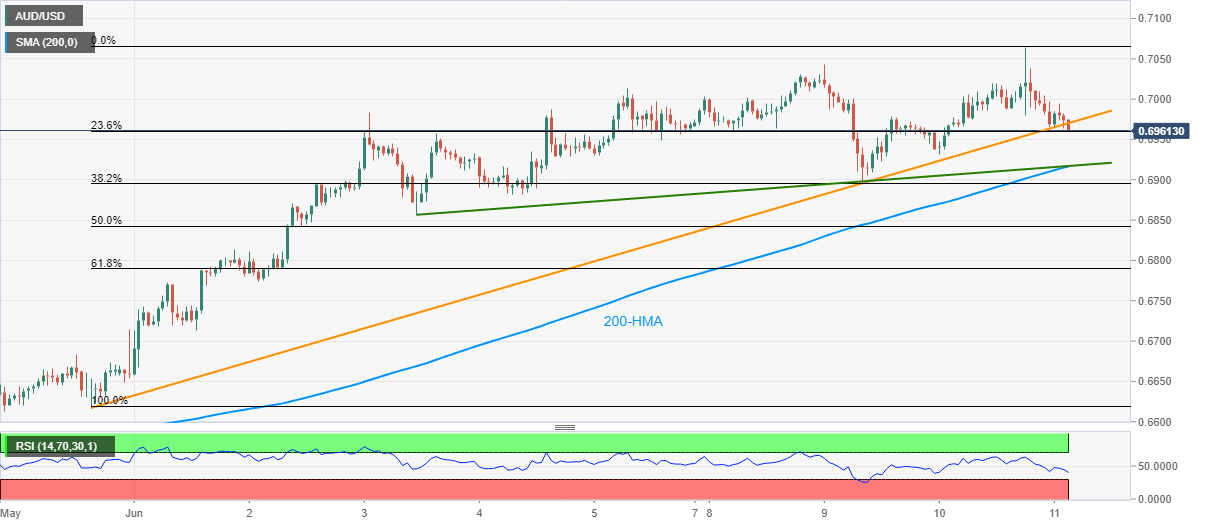

- AUD/USD steps back from 22-month high to break the immediate trend line support.

- A confluence of weekly support lie, 200-HMA can question the sellers.

- 0.7000 and 0.7030 might offer immediate upside barriers ahead of the multi-day top.

AUD/USD refreshes the intraday low while declining to 0.6949, currently around 0.6953, during the early Thursday. The pair’s U-turn from multi-day high gained momentum after breaching an upward sloping trend line since May 29.

However, a joint of 200-HMA and an ascending support line from June 03, near 0.6915/10, could restrict the pair’s further downside.

In a case where the bears dominate past-0.6910, 0.6855 and 0.6780/75, comprising 61.8% Fibonacci retracement of the pair’s upside between May 29 and June 10, could be their favorites.

Alternatively, the pair’s pullback moves beyond the support-turned-resistance line close to 0.6975 will have to cross 0.7000 and 0.7030 before challenging the latest high near 0.7065.

AUD/USD hourly chart

Trend: Further weakness expected