- AUD/USD refreshes intraday low, fades an uptick following Aussie CPI data.

- Bearish candlestick formation, downbeat oscillators suggest further consolidation of recent gains.

AUD/USD fizzles the upside momentum that recently refreshed the weekly top. The quote marks the day’s low of 0.7735, down 0.13% intraday, while reversing the post-Aussie CPI-led run-up.

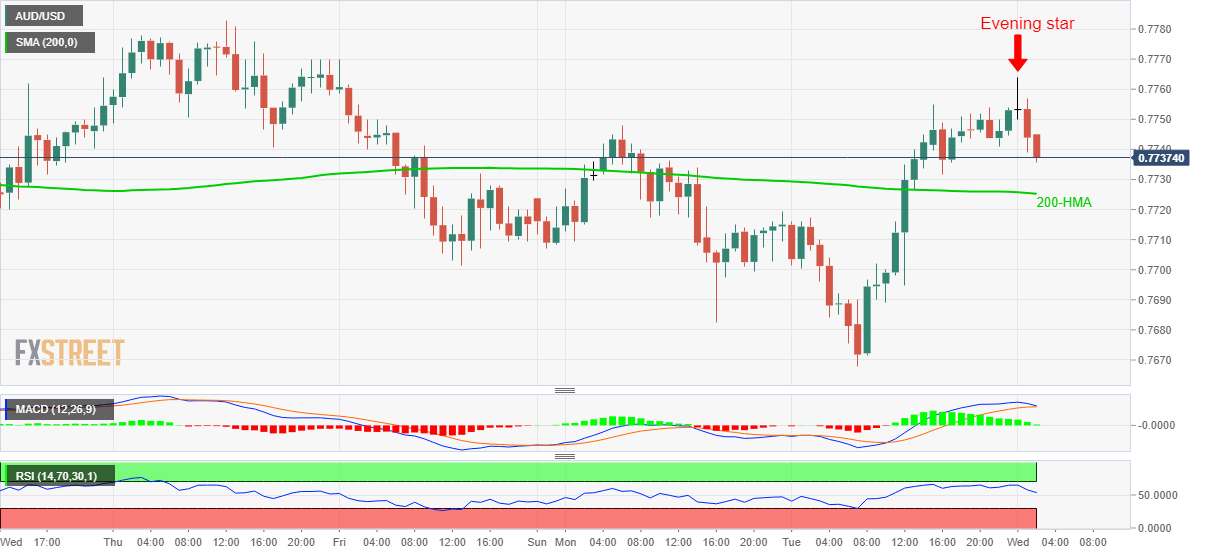

In doing so, the quote portrayed evening star bearish candlestick on the hourly (1H) chart, which in turn joins weakening MACD and RSI to keep the AUD/USD sellers hopeful.

However, a 200-HMA level of 0.7725 is likely to offer a tough barrier for the bear’s entry targeting the monthly low around 0.7640. Also acting as a downside filter is January 18 bottom surrounding 0.7660 and the 0.7700 threshold.

On the flip side, a clear break of the recent high near 0.7765 defies the bearish candlestick formation and will restore the upside momentum targeting the fresh multi-month high above the 0.7800 round-figure.

However, the monthly top near 0.7820 and January 21 peak surrounding 0.7785 can probe the AUD/USD buyers during the run-up to refresh the highest level since April 2018.

AUD/USD hourly chart

Trend: Further weakness expected