- A strong pickup in the USD demand prompted some selling around AUD/USD on Friday.

- The downside remained limited as bulls showed some resilience below the 0.7600 mark.

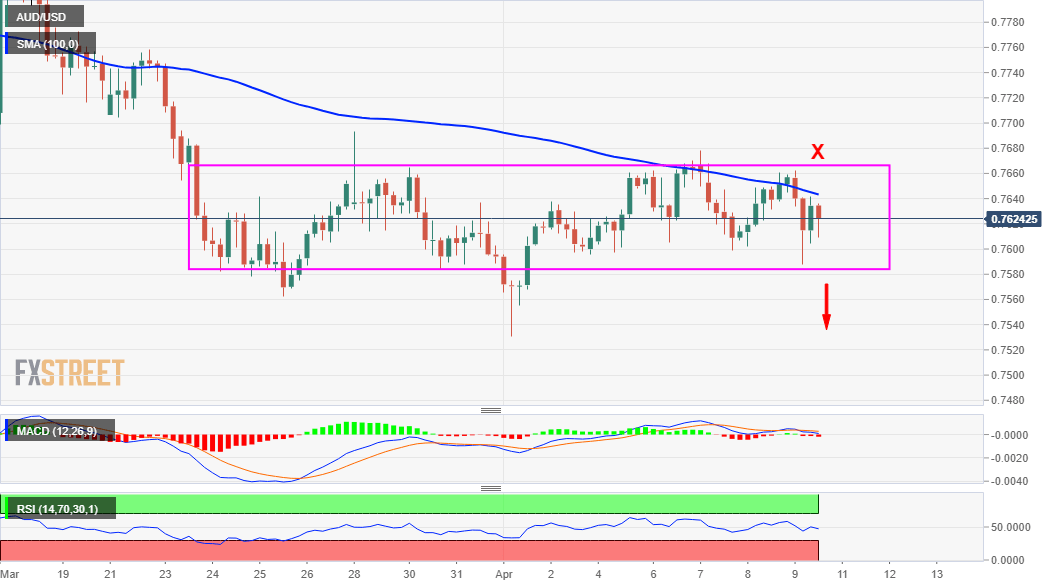

- The recent rangebound moves constitute the formation of a bearish rectangle pattern.

The AUD/USD pair struggled to capitalize on its intraday bounce from over one-week lows and met with some fresh supply near the 0.7640 region. The pair was last seen trading just above the 0.7600 mark, down around 0.55% for the day.

A strong pickup in the US Treasury bond yields assisted the US dollar to stage a solid rebound from two-week lows. This, in turn, was seen as a key factor that prompted some aggressive selling around the AUD/USD pair on Friday.

From a technical perspective, the pair has been oscillating in a 100 pips broader trading range since March 24. Bulls have been struggling to break through the 0.7660-70 resistance zone but showed some resilience below the 0.7600 mark. The range-bound price action constitutes the formation of a rectangle on short-term charts. Given the recent pullback from multi-year tops, around the 0.8000 psychological mark, this could be categorized as a bearish continuation pattern.

The rectangle pattern, however, is not complete until a breakout has occurred. This makes it prudent to wait for a sustained break through the trading range before determining the AUD/USD pair’s next leg of a directional move.

Meanwhile, technical indicators on the daily chart have been drifting lower in the bearish territory and are still far from being in the oversold zone. This, in turn, supports prospects for an eventual break on the downside. Hence, a subsequent slide back towards YTD lows, around the 0.7530, en-route the key 0.7500 handle, remains a distinct possibility. The downward trajectory could further drag the AUD/USD pair towards the 0.7460 support area.

On the flip side, any attempted recovery might continue to confront stiff resistance and meet with some fresh supply near the 0.7660-70 region. That said, a sustained move beyond might negate the bearish outlook. The AUD/USD pair might then aim back to reclaim the 0.7700 round-figure mark. The short-covering move could further get extended and allow bulls to test the next relevant resistance near the 0.7745-50 supply zone.

AUD/USD 4-hour chart

Technical levels to watch