- AUD/USD prints mild losses while extending Friday’s pullback moves.

- 38.2% Fibonacci Retracement of February-April downside adds to the support.

- Monthly top, key Fibonacci retracements will test the bulls during fresh recovery moves.

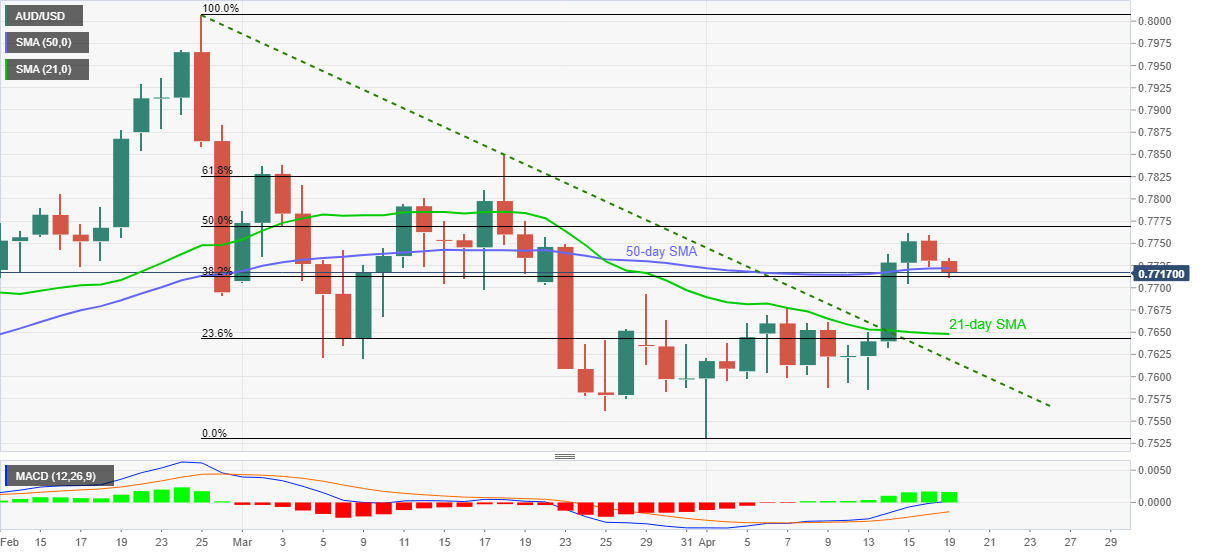

AUD/USD teases the day’s low of 0.7712, down 0.05% intraday around 0.7725 by the press time of early Monday. In doing so, the sellers jostle with 50-day SMA and 38.2% Fibonacci retracement of the pair’s February-April fall amid bullish MACD.

Given the pair’s inability to cross 50% and 61.8% key Fibonacci retracements, AUD/USD is likely to remain depressed. However, bullish MACD and the immediate supports around 0.7720-10 seem to test the bears.

It’s worth mentioning that the late March top near 0.7690 and 21-day SMA level of 0.7648 precede the previous resistance line from late February, close to 0.7620, before confirming the bearish moves.

On the flip side, a fresh monthly high above the latest peak of 0.7762 should recall the AUD/USD buyers targeting the 50% Fibonacci retracement level of 0.7770 as an immediate target.

Though, any further upside will need a clear break above the 0.7800 round figure before challenging the 61.8% Fibonacci retracement level of 0.7825.

Overall, AUD/USD is likely to extend the latest pullback but sellers should wait for a clear break below 0.7710 for fresh entries.

AUD/USD daily chart

Trend: Further weakness expected