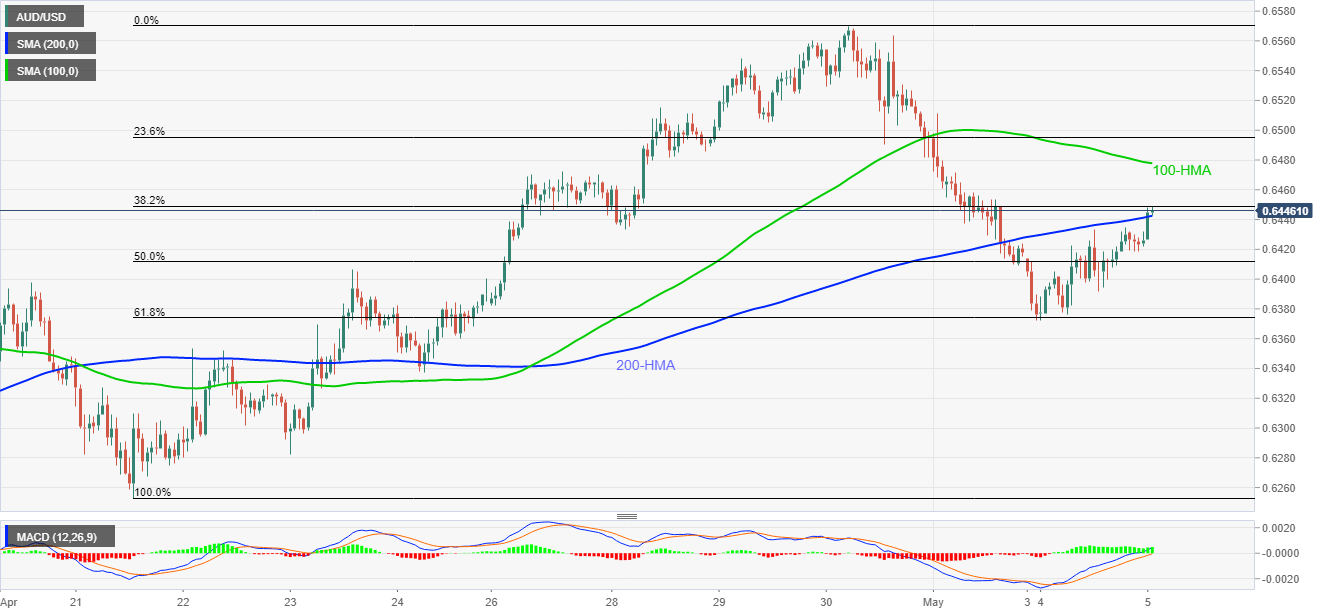

- AUD/USD extends recovery moves from 61.8% Fibonacci retracement.

- 38.2% Fibonacci retracement caps pullback ahead of 100-HMA.

- Bullish MACD, sustained break of key HMA favor buyers.

- RBA widely anticipated keeping monetary policy unchanged, rate statement in focus.

AUD/USD takes the bids near 0.6445, up 0.31% on a day, during the early Tuesday’s trading.

While extending its pullback from 61.8% Fibonacci retracement of late-April upside, the Aussie pair recently pierced 200-HMA.

Though, 38.2% Fibonacci retracement level around 0.6450 seems to guard the immediate upside before shifting the market’s attention to 100-HMA, at 0.6478 now.

Alternatively, 0.6410 level comprising 50% Fibonacci retracement can offer a nearby rest during the pair’s U-turn ahead of the key Fibonacci support close to 0.6370.

If at all the bears dominate past-61.8% Fibonacci retracement level, 0.6330 and 0.6280 can entertain them.

Also read: RBA Preview: Markets looking for forecasts, not action

AUD/USD hourly chart

Trend: Further recovery expected