- AUD/USD takes the bids to refresh highest levels since April 2018.

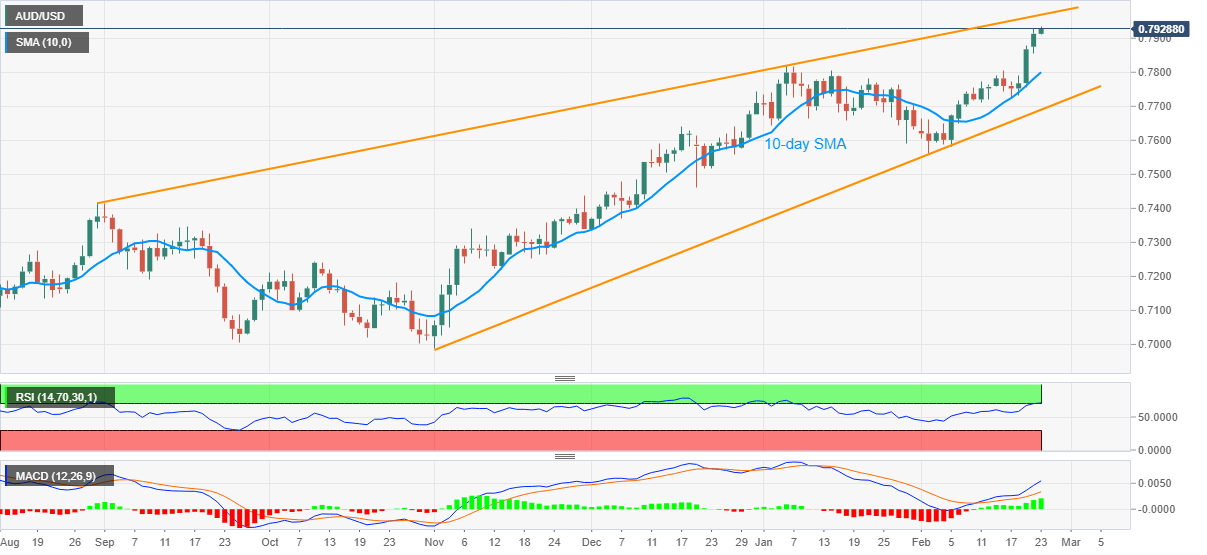

- Sustained trading beyond 10-day SMA, bullish MACD favor further upside.

- Key trend line hurdle, overbought RSI test the bulls.

AUD/USD rises to a fresh high since April 2018 while taking the bids near 0.7935, currently up 0.22% intraday around 0.7930, during the early Tuesday.

In doing so, the aussie pair extends its U-turn from 10-day SMA, portrayed last week, amid the bullish MACD.

However, an upward sloping trend line from August 31, 2020, at 0.7970 now, will join the overbought RSI conditions to challenges the AUD/USD bulls.

If at all the quote ignores the overbought RSI line and crosses the stated trend line hurdle, the 0.8000 psychological magnet will be the key to watch.

Alternatively, pullback moves may eye the 0.7900 round-figure before highlighting tops marked on April 2018 and January 2020 around 0.7820-15.

Also acting as short-term support is the 10-day SMA level of 0.7800 and an upward sloping support line from November 02, near 0.7690.

It should, however, be noted that a clear downside break of the 0.7690 will confirm the ‘rising wedge’ bearish pattern and recall the AUD/USD bears.

AUD/USD daily chart

Trend: Bullish