- AUD/USD managed to find some support near the 0.7600 mark and edged higher on Thursday.

- The overnight break below 200-hour SMA. ascending channel support favours bearish traders.

- The pair remains vulnerable to retest YTD lows before eventually dropping to sub-0.7500 levels.

The AUD/USD pair edged higher during the Asian session and climbed to fresh daily tops, around the 0.720 region in the last hour.

The underlying bullish sentiment in the financial markets was seen as a key factor lending some support to the perceived riskier aussie. That said, a modest pickup in the US Treasury bond yields underpinned the US dollar, which, in turn, capped any meaningful gains for the AUD/USD pair.

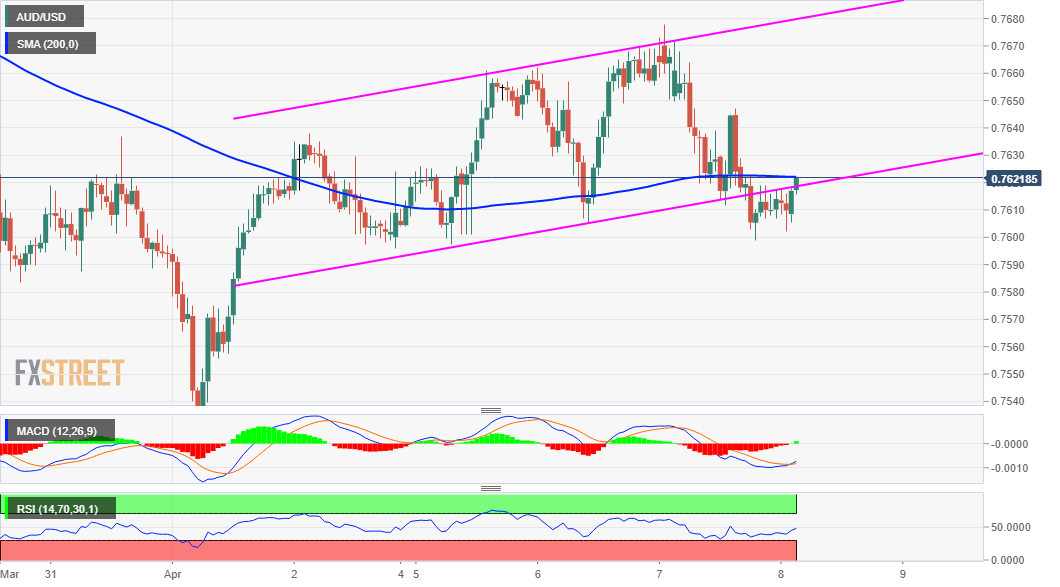

Looking at the technical picture, the AUD/USD pair on Wednesday confirmed a bearish break through confluence support, comprising of 200-hour SMA and the lower end of a three-day-old ascending channel. The set-up favours bearish traders and supports prospects for a further depreciating move.

That said, bulls have been showing some resilience near the 0.7600 mark, which should act as a key pivotal point for short-term traders. A convincing break below will reaffirm the negative bias and turn the AUD/USD pair vulnerable to retest YTD lows, around the 0.7530 area touched earlier this April.

Meanwhile, technical indicators on daily/hourly charts are holding in the negative territory and add credence to the bearish outlook. Hence, some follow-through weakness towards the 0.7500 psychological mark, en-route the next relevant support near the 0.7460 zone, remains a distinct possibility.

On the flip side, any meaningful recovery might continue to confront stiff resistance near the 0.7660-70 heavy supply zone. This coincides with the top boundary of the mentioned channel, which if cleared decisively might prompt some short-covering move and push the AUD/USD pair to the 0.7700 mark.

AUD/USD 1-hour chart

Technical levels to watch