- With renewed risk appetite, the AUD/USD reached a new intraday high and continued its 3-week uptrend.

- A Biden-Putin summit may lead to a de-escalation of Ukrainian-Russian tensions.

- The latest cautiously bullish Australian Purchasing Managers’ Index reinforces the bullish bias.

During Monday’s Asian session, bids push the AUD/USD price toward a fresh intraday high around 0.7200, continuing its previous three-week rally.

–Are you interested in learning more about STP brokers? Check our detailed guide-

A positive headline on the Russian-Ukrainian issue has recently gained momentum for the risk barometer pair. Bullish sentiment is also supported by the People’s Bank of China (PBOC) and the upbeat Commonwealth Bank of Australia (CBA) February PMI data.

The Associated Press reported that French President Emmanuel Macron proposed a summit between US President Joe Biden and his Russian counterpart Vladimir Putin. In the news, we were also told that both sides had agreed to the summit’s “principle.”. After the news broke, the White House said, “President Biden has agreed in principle to meet with President Putin again after this summit, as long as an invasion does not take place.”

Just minutes earlier, the news had helped S&P 500 futures erase losses in early Asian trading, while gold prices were knocked off a fresh eight-month high.

The NBK kept its policy rate (LPR) at 3.7% at its last monetary policy meeting, which is to note. Also supporting the upside potential of the AUD/USD pair are the more-than-expected and earlier readings of central bank manufacturing and services PMIs.

In addition, Fed’s recent dovish comments are also putting pressure on Treasury yields and the US Dollar, which is helping AUD/USD buyers. The Federal Reserve Bank of Chicago president and an FOMC member, Charles Evans, said Friday that the Fed’s current policy is “wrong” given high inflation, but there may be no need to turn hawkish. According to John Williams, President of the New York Federal Reserve Bank and No. 2 on the Fed’s policy-setting group, there is no compelling reason to take a big step at the beginning.

AUD/USD prices have been helped by risk appetite lately, but upcoming meetings/summits will significantly impact the near-term direction. For example, the Reserve Bank of Australia (RBA) continues to steer clear of hawkish comments as it releases Australia’s fourth-quarter wage price index on Wednesday.

AUD/USD price technical analysis: More gains on cards

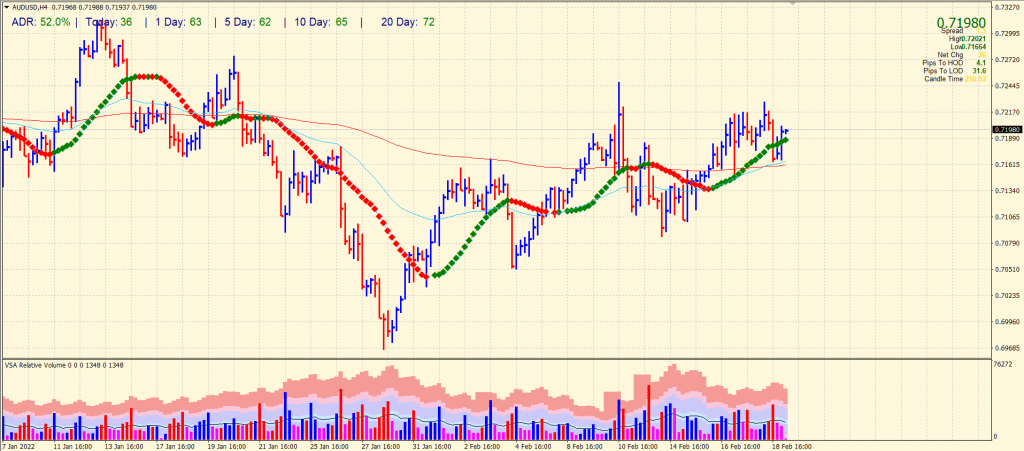

The AUD/USD price remains well supported by the conjunction of 50-period and 200-period SMAs on the 4-hour chart. The recent 4-hour price bar is now above the 20-period SMA as well. It shows that the pair has triggered a bullish reversal.

–Are you interested in learning more about forex robots? Check our detailed guide-

However, the major hurdle for the bulls is to overcome the high of Friday’s upthrust bar and swing high of 0.7230 area. In addition, the average daily range is 52%, which is quite high. Hence, the probability of a bullish breakout is high too.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money