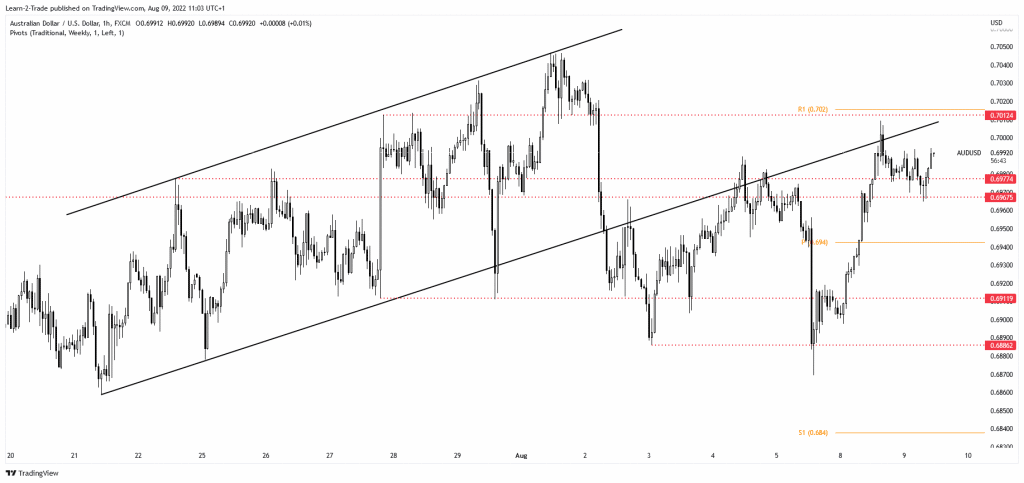

- The AUD/USD pair was rejected by the channel’s downside line again.

- DXY’s rally could push the pair down.

- Only a new lower low may activate a broader drop.

The AUD/USD price rallied in the short term after retesting the 0.6967 historical level. The pair is trading at the 0.6991 level at the time of writing. It is just to reach the 0.7000 psychological level again.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The pair maintains a bullish bias in the short term as the Dollar Index drops after failing to activate a larger growth. Technically, the currency pair moves sideways, so we’ll have to wait for a fresh trading opportunity.

Fundamentally, the Australian Westpac Consumer Sentiment dropped by 3.0%, while the NAB Business Confidence peaked at 7 points versus 2 points in the previous reporting period. On the other hand, the US NFIB Small Business Index was reported at 89.9 points above the 89.5 expected. Later, the US will release its Prelim Nonfarm Productivity, the Prelim Unit Labor Costs, and the IBD/TIPP Economic Optimism.

Still, only the US inflation could bring strong movements tomorrow. The CPI is expected to report a 0.2% growth in July, while the Core CPI may register a 0.5% growth.

AUD/USD price technical analysis: Bullish dominance

The AUD/USD pair rallied after registering only a false breakdown below the 0.6886 level. It has registered only a false breakout above the 0.7000 key level and through the channel’s downside line.

-Are you looking for the best CFD broker? Check our detailed guide-

As long as it stays above 0.6967 – 0.6978, the price could try to approach and reach at least the 0.7012 level. A valid breakout above the R1 (0.7020) could validate further growth. Failing to stabilize above the channel’s upside line may signal exhausted buyers around this level. After escaping from the up-channel pattern, the AUD/USD pair was expected to develop a more significant drop.

So, a broader downside movement could be activated only by a valid breakdown below 0.6886. DXY’s rally could force the USD to appreciate versus its rivals. In the short term, the pair could continue to move sideways.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.