- AUD/USD is attempting to gain as risk sentiment slightly improves.

- Powell’s testimony is due on Thursday while markets see low volatility.

- Declining bond yields are weighing on the Greenback.

The AUD/USD price found a downside correction today. But it is trying to surge higher now as the risk sentiment improves slightly.

Fed Chairman Powell is due to speak on Thursday before the Senate Banking Committee. Another lullaby for the markets, it has everything under control. Stock indices are at their highs, precious metals are in correction, the VIX volatility index is at the lows, in a word – positive in the markets. So how long will the unbridled fun last? In my opinion, until the first serious signals about the curtailment of asset purchase programs.

From temporary inflation to temporary recovery!

If, before July, investors were actively discussing the topic of whether the surge in consumer prices would turn out to be a transient phenomenon, then the spread of the Delta variant of COVID-19 across the world made them doubtful whether the world economy would be able to recover rapidly or not. Ultimately, the Delta may be followed by Epsilon, Zeta and other letters of the Greek alphabet down to Omega. Fears about this forced them to flee to US Treasury bonds, the fall in yields of which was a serious blow to the Greenback.

-Are you looking for the best CFD broker? Check our detailed guide-

US 10-year Treasuries continue to signal us the seriousness of the threat of new virus restrictions. The Delta strain is circulating worldwide, and benchmark US debt yields are trading near 1.33, reflecting risk-off sentiment in the market.

A series of disappointing data from the United States, the Eurozone and China, rumors about the spread of a new strain of coronavirus and a desire to cover the shorts in Treasuries were enough to push bond rates down. This is often perceived as a signal of an imminent slowdown in the US economy, which could return the Fed’s tolerance policy and weaken the Dollar. As a result, AUD/USD rose for two trading sessions in a row from the end of the week to July 9, despite the contradictory dynamics of the stock market.

-Are you looking for automated trading? Check our detailed guide-

This fits into the scheme of the temporary nature of its dispersal and allows the Federal Reserve to re-use the policy of passive contemplation. In fact, most of the 64 Wall Street Journal experts believe that high CPI values “‹”‹will be long-lasting. They predict core inflation at 3.2% by the end of 2021. In 2022-2023, the indicator will slow down to 2.3%, but its average value in 2021-2023 will be 2.58%. We are talking about the highest level since the 1990s, which is likely to push the Fed towards monetary restriction.

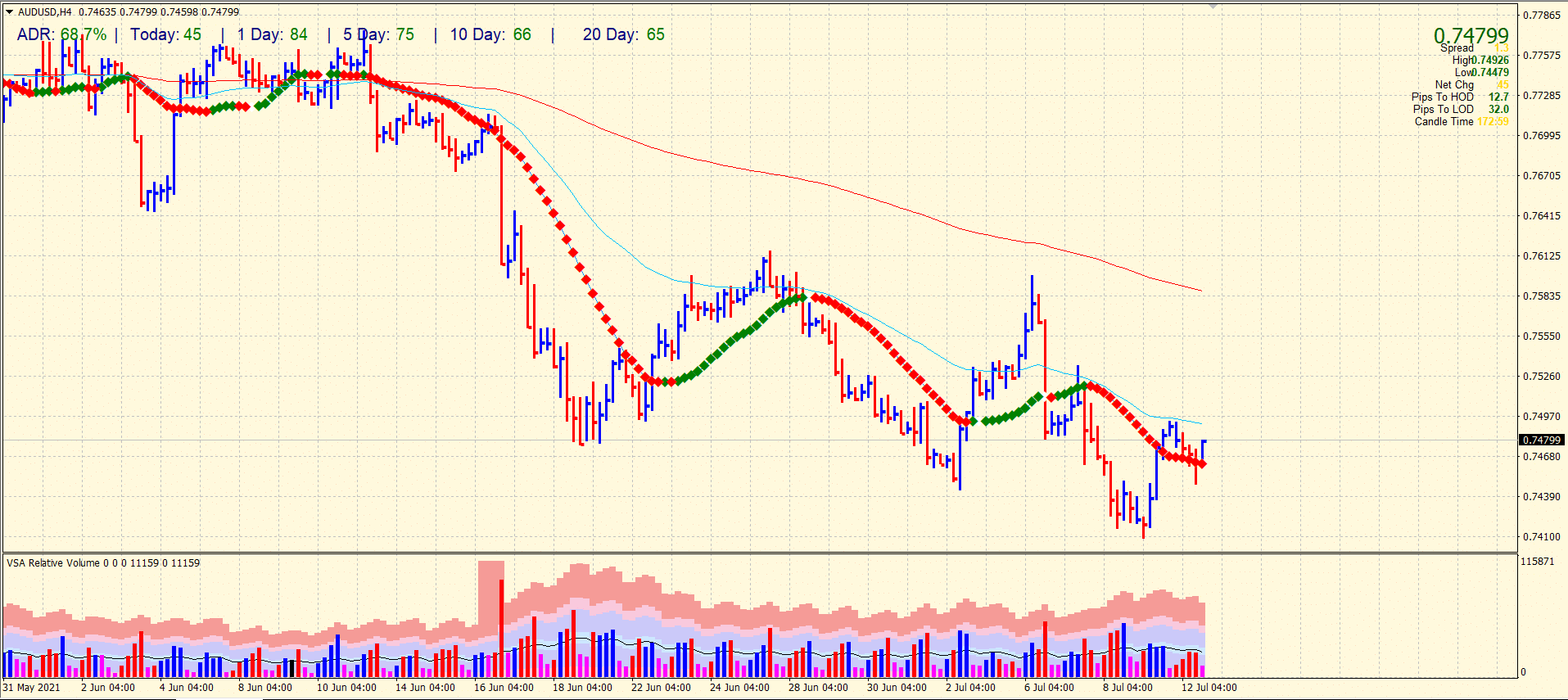

AUD/USD price technical view: Key levels to watch

The 4-hour chart is trying to surge beyond the 20-period SMA. However, the recent down wave got increasing volume. This can let the gains capped under 50-SMA (0.7490). The average daily range for the pair is near 70% on the day. Hence, we expect a mild rise towards the 0.7490 – 0.7500 zone.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.